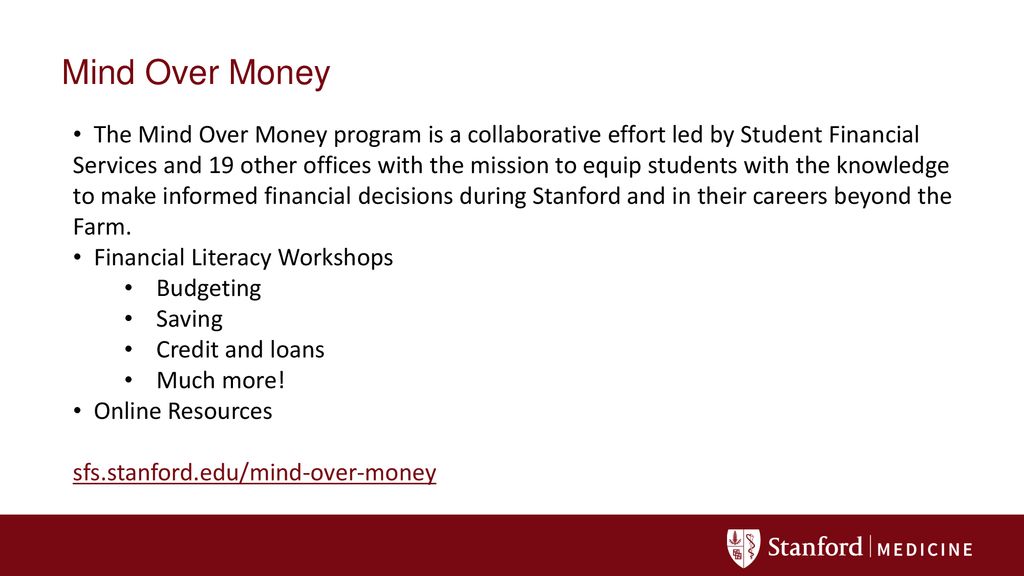

From the dschool, this empathy planner tool is used to help you see problems and experiences from different perspectives Empathy is the foundation for a strong, human centered point of view, and a great design project demands a rich empathy experience Stanford University's Mind Over Money Financial Literacy Program At Stanford University, the Mind Over Money financial literacy program was formed as a campuswide resource to help educate and inform students on financial decisions that need to be made both as a student and as a graduateStanford Student Affairs runs Mind Over Money, a program with tools and resources for financial literacy Fellowships The NSF PreDoctoral Graduate Research Fellowship is a threeyear prestigious, nationallycompetitive (about 10% of applicants are successful) fellowship

Mind Over Money

Mind over money stanford

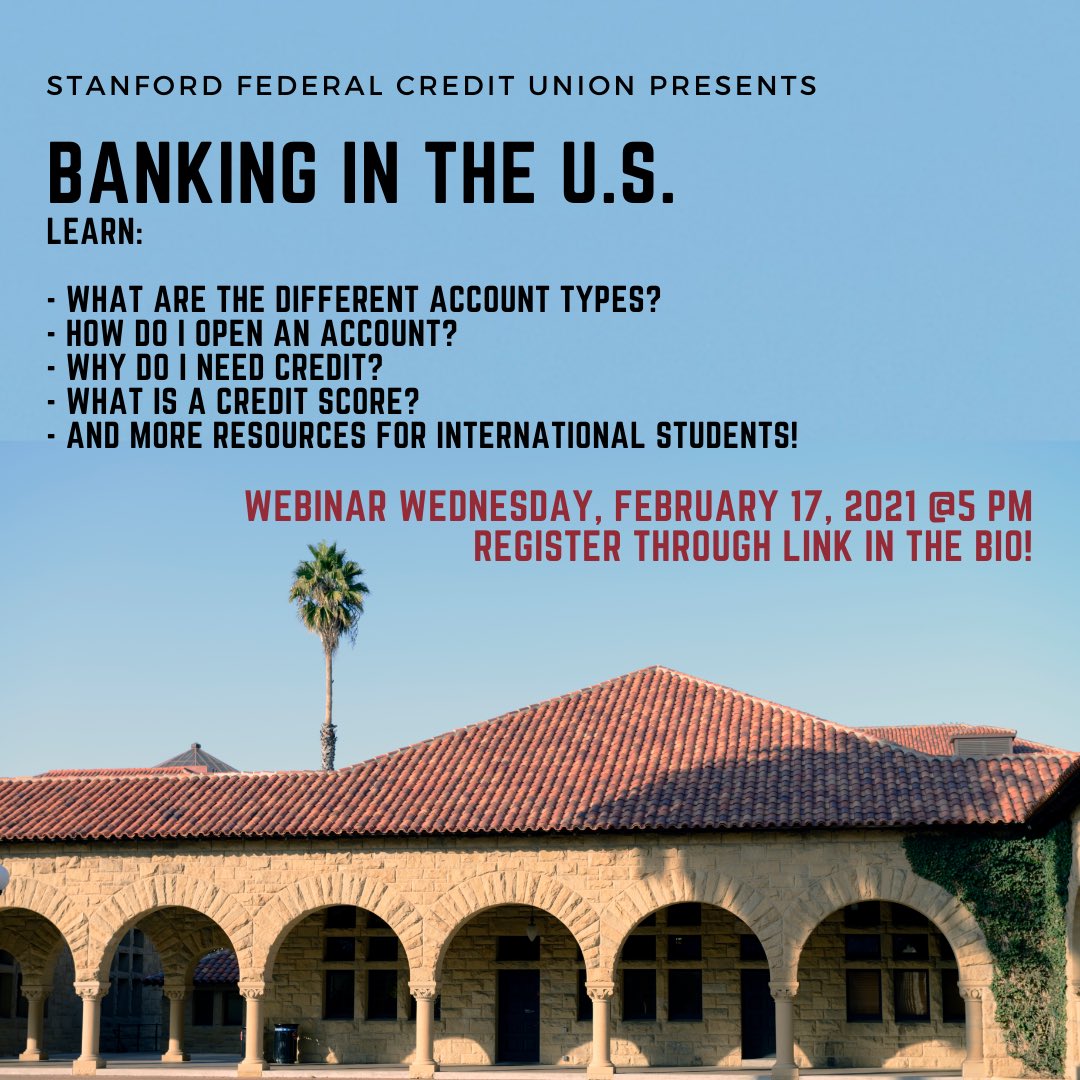

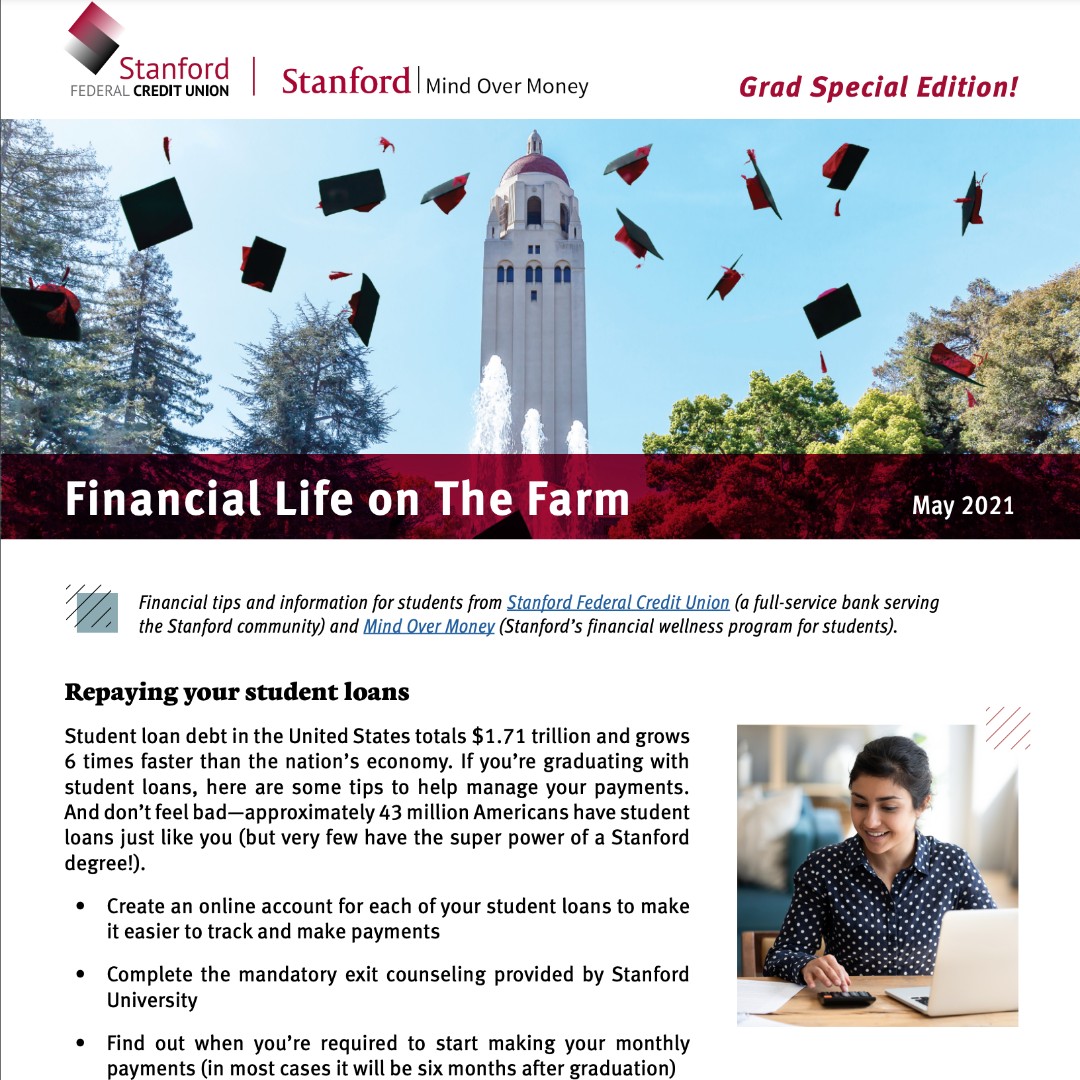

Mind over money stanford- After taking Mind Over Money's winter course, Financial Wellness 1, Stanford students Jorge AvelarLopez, ', and Rachel Hinds, ',The Stanford community) and Mind Over Money (Stanford's financial wellness program for students) May 21 Grad Special Edition!

Stanford University Vpue Approaching Stanford Handbook 19 Page 58 59 Created With Publitas Com

Workshop times can be found on Stanford's Mind Over Money website This workshop is only for US citizens, permanent residents, and those considered resident aliens for tax purposes To determine if you are a nonresident or resident alien for tax purposes, please see information here "Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list" Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,In this workshop, we will define what financial wellbeing means to you

Mind Over Money has designed several templates for different time frames monthly, quarterly, summer 3 Plan for the current you and the future you Assuming you are a student, you are likely spending money on tuition, housing, food, books, educational supplies, travel, and personal expenses like your phone bill and toiletriesInternational students considered nonresidents for tax purposes cannot easily or efile their taxes and as such, Stanford University provides GlacierTax Prep software for these students Filing on Paper While filing by hand is intimidating, it can be a fairly straightforward process Start by looking at Form 1040EZ$0 $0,000 $400,000 $600,000 $800,000 $1,000,000 $1,0,000 $1,400,000 $1,600,000 1 2 3 THE COST OF WAITING Start contributing at age 35 Start contributing at age 25 Projected balance

If you're just starting out—and starting from square one—Stanford's Mind over Money learning modules have the essentials on managing your finances, from basic budgeting to understanding housing expenses to paying off credit card debtBut when you're ready to think beyond next month's rent, here's some expert adviceMind Over Money, Stanford's financial wellness program, aims to provide all students with the knowledge, skills, and habits to be financially well during your time at Stanford, and beyond Any Stanford student or postdoc can meet oneonone with a Mind Over Money Financial Coach for free Most of the 50 Stanford's Mind Over Money program – part of Student Financial Services – is here to help alleviate your concerns and guide you to financial wellbeing Although Tax

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Misery Stanford Magazine

Mind Over Money aims to equip Stanford students with financial skills and knowledge to make informed financial decisions during and after The Farm If you find yourself with financial questions after graduation, ask Mind Over Money!Mind Over Money Your Path to Wealth and Happiness By Eric Tyson, MBA ' CDS Books 06 Plenty of intelligent and wellintentioned people with access to financial information fail to master their personal finances These folks would find nothing to object to about Eric's three principles of personal finance spend less than you earnMind Over Money's free 11 financial coaching program provides students with universitytrusted individuals with whom to share their personal financial circumstances, and the opportunity to explore ideas, concepts, and resources Find a Financial Coach

Personal Finance Resources For Stanford Students Mind Over Money

How To Save More Money Npr

Thanks for your interest in the Associate Director, Mind Over Money Program position Stanford is an equal employment opportunity and affirmative action employer All qualified applicants will receive consideration for employment without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disabilityPart of the mission of Mind Over Money is to "To foster a campus culture of financial awareness and understanding, encourage financially healthy behaviors, and help students build the skills and aptitude to seek reliable financial information beyond Stanford" Through this site many resources are available to students and families includingMind Over Money's 11 financial coaching program provides students with the opportunity to share their personal financial circumstance with universitytrusted individuals and explore ideas and build skills Students interested in meeting with a coach should read the Coaching Overview and the Financial Coach Bios below, and then submit a Coaching Request Form

Mind Over Money Finance Coach For Black Women

Mind Over Money Office Hours Student Financial Services

Undergraduate Financial Aid Application—Summer 21 To apply for financial aid for Summer Quarter, students with a complete financial aid application on file for the current academic year need only to submit this completed form to the Financial Aid Office by June 1 Students who have not applied for financial aid for the current academicMind Over Money Students will have full access to the programs and services provided by Mind Over Money In these unusual times, we particularly recommend students utilize the free 11 financial coaching program to help plan for and manage financial circumstances Students will have full access to the programs and services provided by MindThe Stanford community) and Mind Over Money (Stanford's financial wellness program for students) February 21 Start young, retire young!

Mind Over Money

Students Stanford Federal Credit Union

"For a long time, I thought that we should have some way to deal with that," he said "There are bits and pieces of that all over Stanford now – like the financial wellness class, 'Mind over Money' — but I thought maybe we needed a more formal undergraduate course that was widely available" Fast forward to autumn 18"Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list" Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,Promotes diversity, inclusion and respect;

1cqes9ne9yju4m

Stanford Offers New Expanded Financial Wellness Opportunities For Students Stanford News

Associated Students of Stanford University (ASSU) Student Activity Fees Waiver Campus Health Service Fee 21 Health Insurance and Campus Health Service FeeAs difficult as it may be to think about retirement when you're still in school, you should begin saving for retirement just as soon as you're able The younger you are when you start investing, theAt Stanford University, researchers stumble on a possible answer Their research, at first, has nothing to with money It isn't even being conducted by economists Mind Over Money Written

Stanford Moves To Stop Providing Funds To Its University Press

Stanford Mind Over Money Youtube

Mind Over Money is proud to be part of Student Affairs, which advances student development and learning;Your student bill or student loans?Herrero Builders Mar 21 Present3 months Stanford, California, United States Working parttime at the Stanford Hospital PodD Renovation Project

Mind Over Money Financial Coaches Mind Over Money

Mind Over Matter May Actually Work When It Comes To Health Study Finds

To post a message to all the list members, send email to mindovermoney_financial_literacy@listsstanfordedu You can subscribe to the list, or change your existing subscription, in the sections below Subscribing to mindovermoney_financial_literacy Subscribe to mindovermoney_financial_literacy by filling out the following form Mind Over Money Another course offered through the Mind Over Money program, Stanford's nationally recognized financial wellness program, is growing in popularity Mind Over Money, a program of Student Financial Services, is guided by a Leadership Advisory Board, which includes staff members from offices and programs across campus, including Stanford Athletics, the Financial Aid Office, the Office of the Vice Provost for Graduate Education, the Diversity and FirstGen Office and the Stanford Center on Longevity, as

Mind Over Money Finance Coach For Black Women

Stanford Mind Over Money Photos Facebook

Financial coaching strives to help students and postdocs develop skills and behaviors they can improve upon independently over time Coaching sessions are entirely free to Stanford students and postdocs Mind Over Money also provides personal finance training with learning modules, recorded workshops, and budget templatesTo expedite your payment, please use Stanford ePay Due to pandemicrelated delays, please allow 24 weeks for paper check processing Read student communications sent from our office here Mind Over Money Budgeting Workshop Student Affairs"Mind Over Money is a valuable resource for individuals wanting to break free from a troubled financial past and create a healthy current relationship with money that can create future financial success It is Must reading on everyone's Now list" Philip Zimbardo, PhD, Professor Emeritus of Psychology, Stanford University,

Amazon Com Inside The Investor S Brain The Power Of Mind Over Money Peterson Richard L Books

Stanford Mind Over Money Home Facebook

Investing Overview Unread Value vs GrowthMarch For Our Lives Stanford Mariachi Cardenal de Stanford Mechanical Engineering Women's Group Medical Students with Disability and Chronic Illness Men's Club Basketball Mexican Association of Graduate Students at Stanford Mind Over Money Financial Wellness MINT Magazine Mixed CompanyStanford University undergraduate () studying HumanComputer Interaction in the department of Computer Science Mind Over Money Student Program Associate Stanford

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Connect with Mind Over Money for your financial wellness learning modules you can do on your own time, coaching, virtual events, and additional resources Practice a minute meditation or watch a webinar from the Stanford Medicine Health and Human Performance teamMind Over Money Courses at Stanford 1019 Winter 19 1 unit WELLNESS 1 Financial Wellness for a Healthy Long Life (1unit)Richard L Peterson, Inside the Investor's Brain The Power of Mind over Money (Wiley 07) Richard Peterson is a medical doctor with a residency in psychiatry, and with postgraduate training in neuroeconomics from Stanford University He is a former stock trader, Associate Editor of The Journal of Behavioral Finance, a highlevel professional

Personal Finance Resources For Stanford Students Mind Over Money

3 Things Money Does To Your Brain Inc Com

Banks and Credit Unions Transportation Costs InsuranceAnd empowers students to thriveThe Mind Over Money program is the top rated university level student financial wellness program that seeks to provide students with the tools they need to be financially well throughout their life In our partnership with them, we are bringing tools and resources for studying the impact these programs have on behavior change, then working collaboratively to leverage validated models

Mind Over Money Financial Coaches Mind Over Money

Difference Making College Financial Literacy Programs Lendedu

May th Mind Over Money X FLIP X FLI Office FLInancial Wellness Attend this financial wellness workshop hosted by Angela Amarillas, the Mind Over Money Associate Director, as well as the Firstgen, LowIncome Partnership (FLIP) and the Firstgen, LowIncome (FLI) Office!Models and Methods For Behavior Change Support Our Work Search formMind Over Money aims to serve as a campuswide resource to equip students with a foundation to make informed financial decisions during their time at Stanford and in their careers and

Mind Over Money

Mind Over Money Nova Pbs

Mind Over Money equips students with the knowledge to make informed financial decisions during Stanford and in their careers beyond graduation Visit Mind Over Money at Stanford Mind Over Money is supported by the Charles Schwab Foundation, a nonprofit dedicated to financial education and empowerment The information presented on this site, including external companies and resources, is educational content and shall not be construed as financial advice or an endorsement provided by StanfordMind Over Money is a Stanford program offering classes, coaches, and many other resources to help students make informed decisions on their finances Back to top Campus Resources

How To Network Your Way Through Stanford University

Mind Over Money

Mind Over Money The Psychology Of Money And How To Use It Better Hammond Claudia Amazon Com Books

Mind Over Money

2

Recorded Workshops For Stanford Students Mind Over Money

Chemwell Mind Over Money Workshop Mind Over Money

Recorded Workshops For Stanford Students Mind Over Money

Financial Aid Entrance Counseling Session Wednesday September 18

Flinances Summer Money Management Mind Over Money

Financial Basics For Entering Medical Students Ppt Download

Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Stanford Flip Happening Tomorrow Twitter

Freelance Danna Gallegos

Mind Over Money Financial Coaches Mind Over Money

The Grumpy Economist University Finances

Mind Over Money Financial Coaches Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Stanford Mind Over Money Photos Facebook

Mind Over Money

Stanford University Athletics Programs College Factual

Mind Over Money Capital One

This Is The Stanford Vaccine Algorithm That Left Out Frontline Doctors Mit Technology Review

Stanford S Mind Over Money Program Fosters Financial Literacy Stanford News

How To Get Into Stanford By An Accepted Student

Mind Over Money At Stanford Mindovermoneysu Twitter

Mind Over Money Financial Coaches Mind Over Money

Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Research All Money Is Not Created Equal Stanford Graduate School Of Business

Stanford University Athletics Programs College Factual

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money Kirkus Reviews

Mind Over Money

Stanford24 Instagram Posts Gramho Com

First Gen Low Income And Claiming A Community Stanford Magazine

Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Stanford The Landlord Affordability Tensions Rise Between Graduate Students And University The Stanford Daily

Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Stanford Fcu Stanfordfcu Twitter

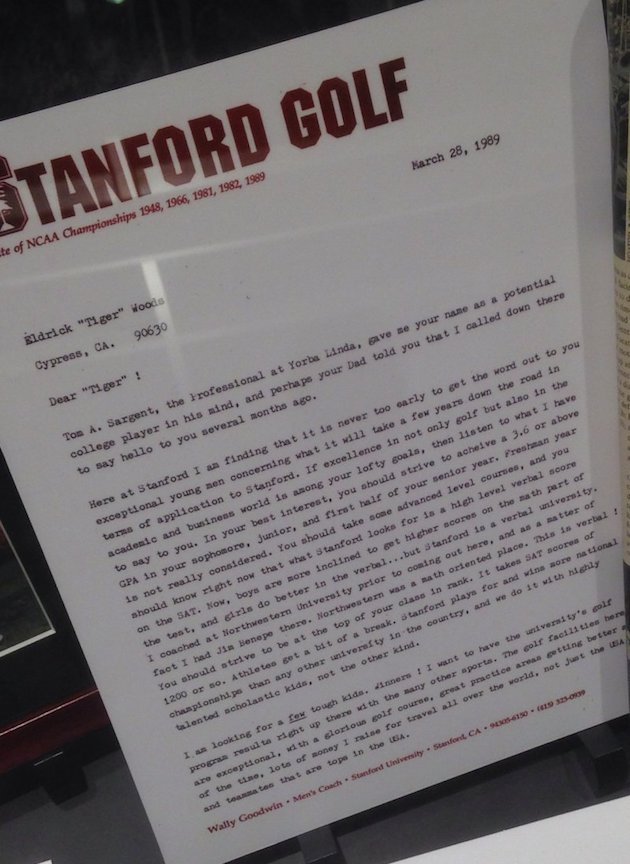

Check Out Tiger Woods Recruitment Letter From Stanford

Mind Over Money Financial Coaches Mind Over Money

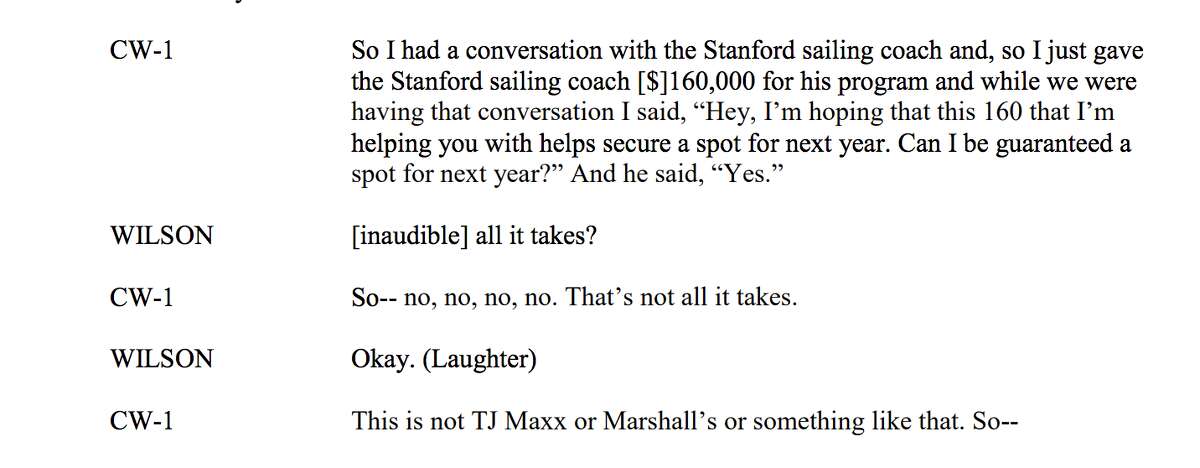

13 Bay Area Parents And Stanford Sailing Coach Implicated In College Admissions Bribery Scandal

Stanford University Vpue Approaching Stanford Handbook 19 Page 58 59 Created With Publitas Com

Students For Workers Rights Labor At Stanford In The Time Of Coronavirus By Center For Comparative Studies In Race Ethnicity Full Spectrum Medium

Mind Over Money

/cdn.vox-cdn.com/uploads/chorus_asset/file/19577734/1172033932.jpg.jpg)

Inside Mind The Gap The Secretive Silicon Valley Group That Has Funneled Over Million To Democrats Vox

Mind Over Money Financial Coaches Mind Over Money

Amazon Com Inside The Investor S Brain The Power Of Mind Over Money Peterson Richard L Books

Financial Aid Entrance Counseling Session Wednesday September 18

Mind Over Money Financial Coaches Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

3

Mind Over Money Capital One

Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money Financial Coaches Mind Over Money

Personal Finance Resources For Stanford Students Mind Over Money

Mind Over Money

Personal Finance Learning Modules Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

Stanford University Cost Options Edmit

Mind Over Money Overcoming The Money Disorders That Threaten Our Financial Health Klontz Brad Klontz Ted Amazon Com Books

How To Write The Stanford University Essays 21

Resources For Graduating Students And Young Alumni Mind Over Money

Mind Over Money The Psychology Of Money And How To Use It Better Hammond Claudia Amazon Com Books

Mind Over Money Financial Coaches Mind Over Money

Resources For Graduating Students And Young Alumni Mind Over Money

Stanford Mind Over Money Home Facebook

Mind Over Money

Mind Over Money Office Hours Student Financial Services

0 件のコメント:

コメントを投稿