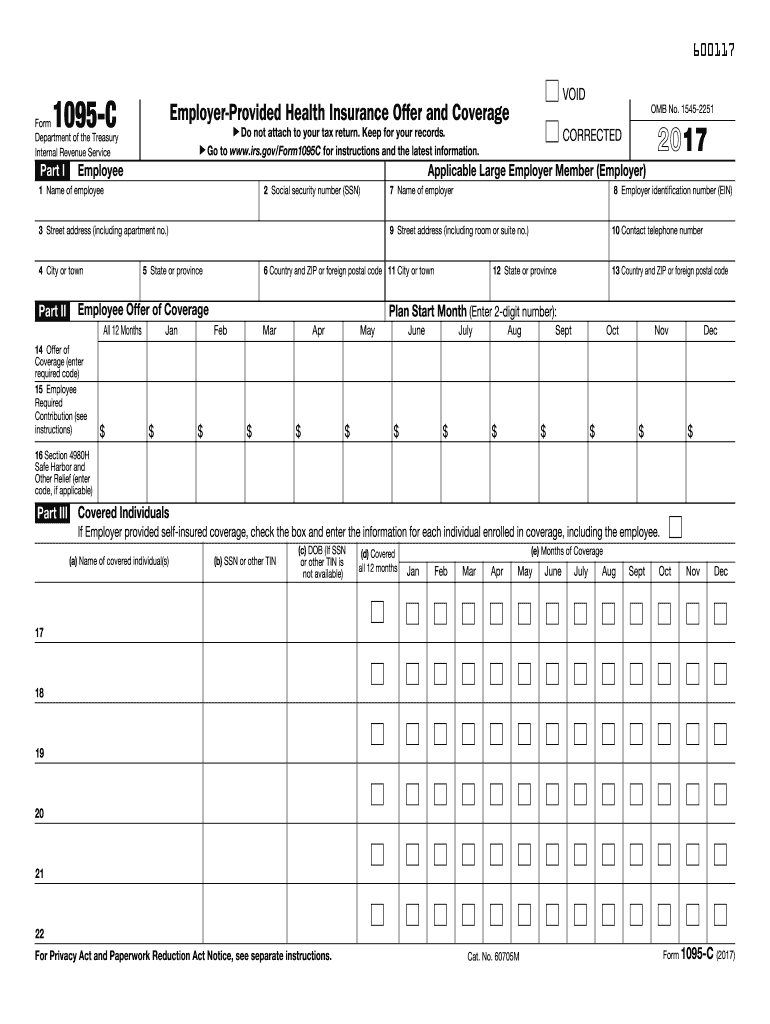

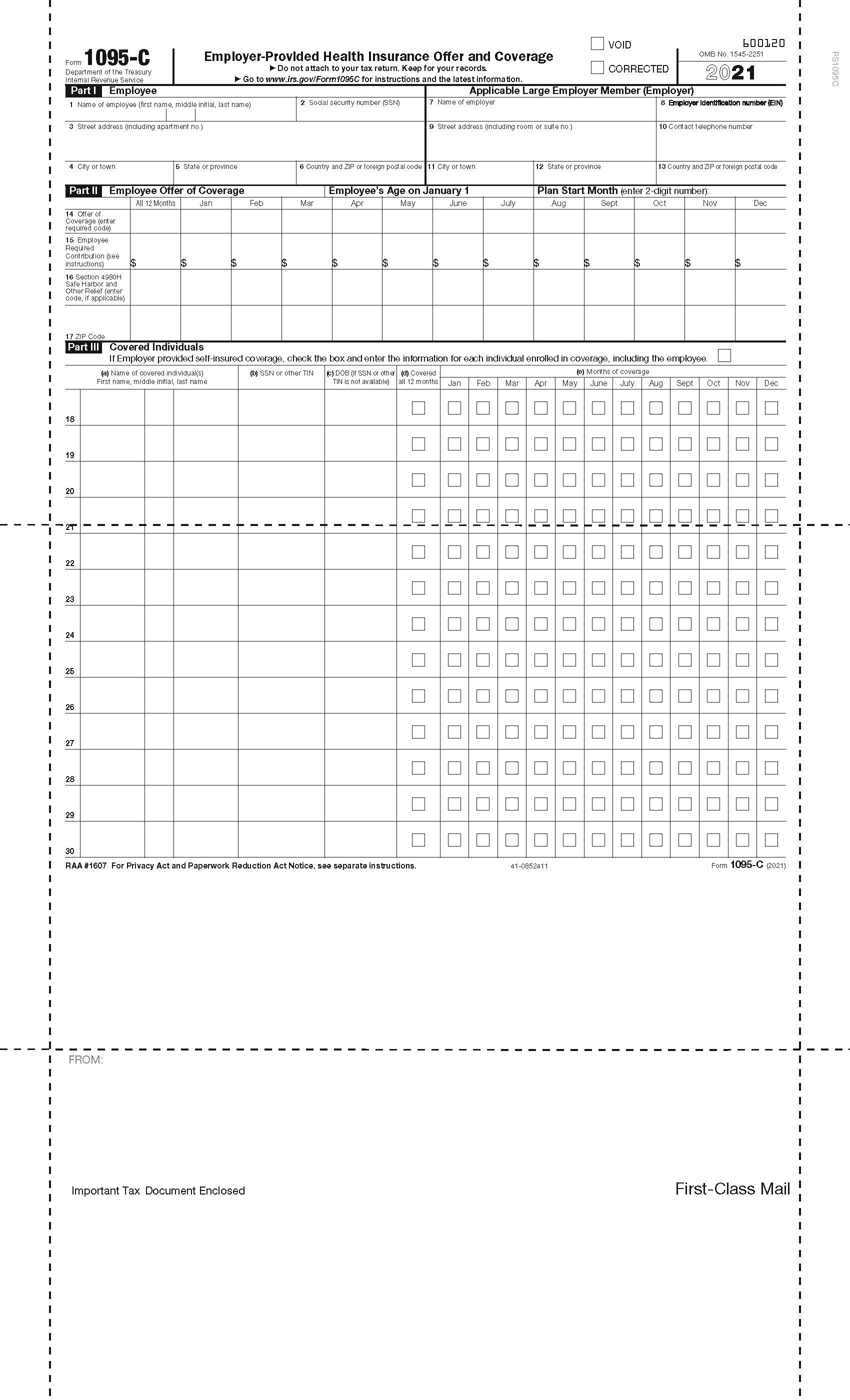

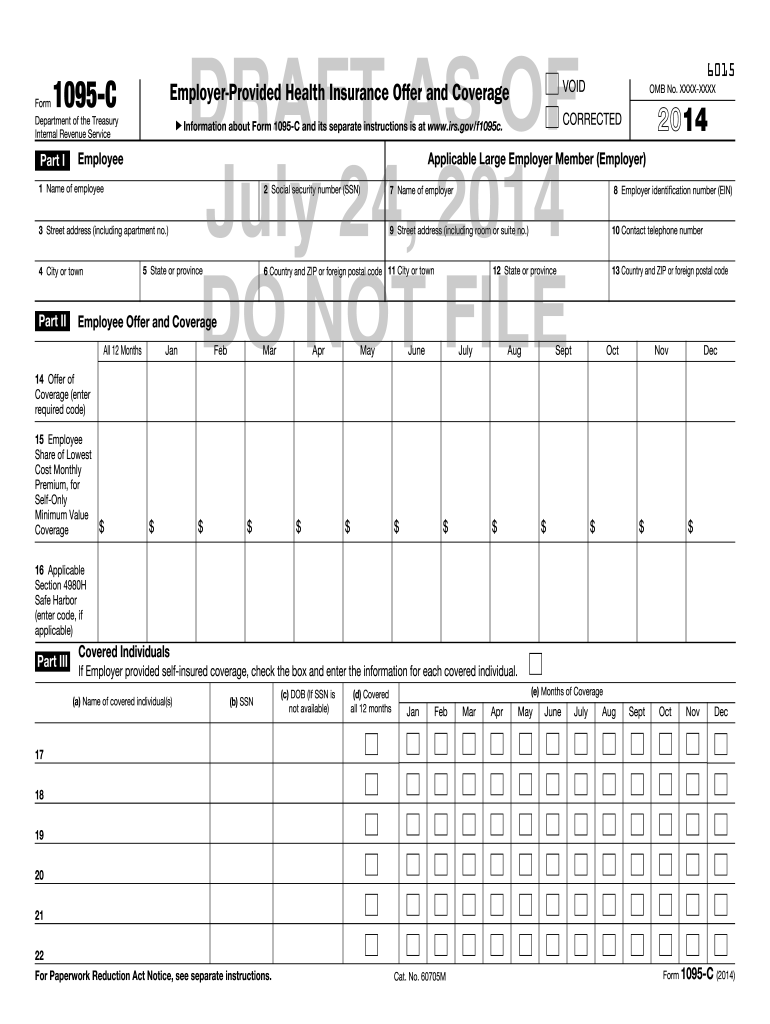

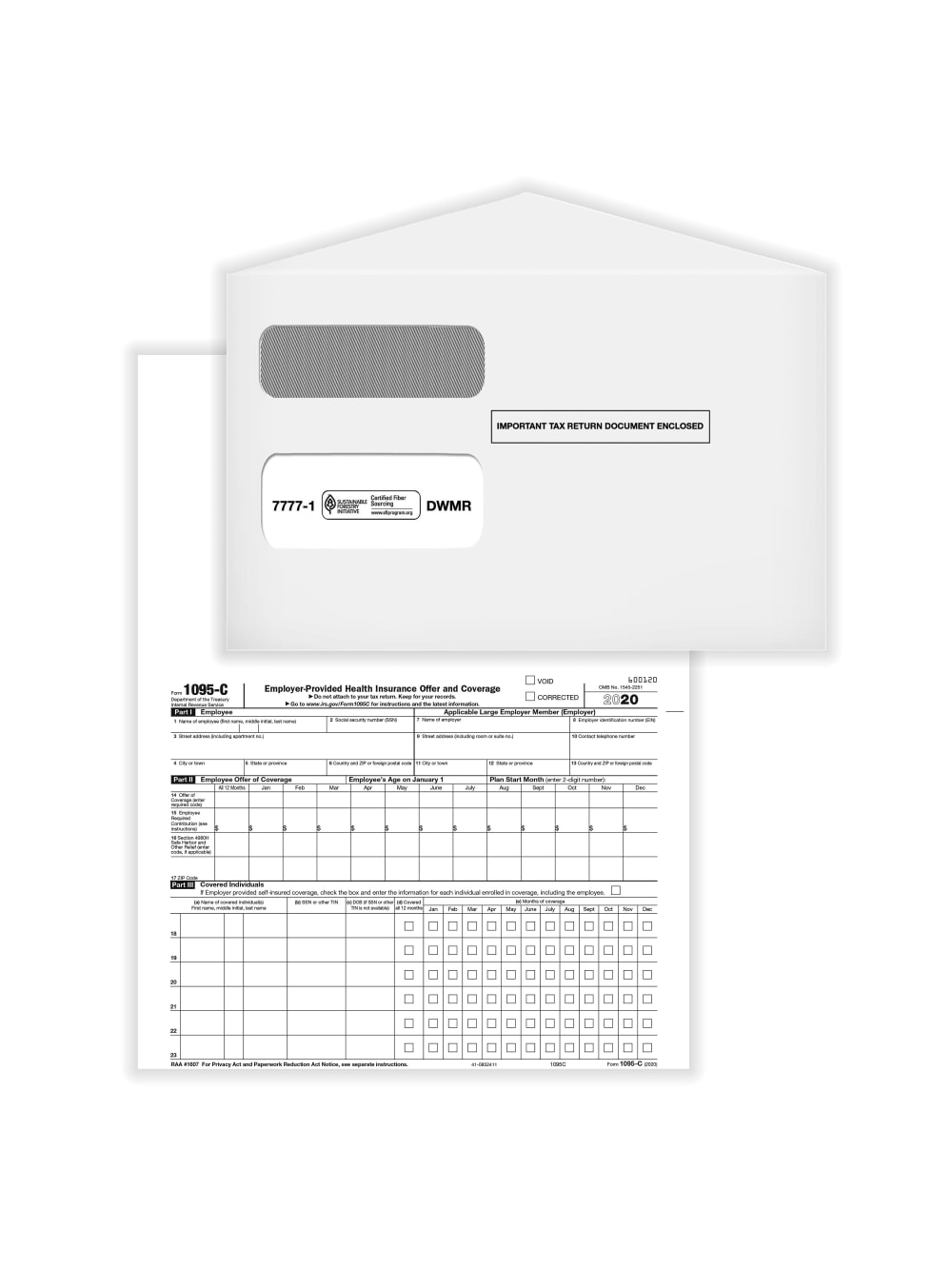

The IRS released its draft IRS Forms 1094C and 1095C, dated as draft as of There are no changes to the Form 1094C from the prior year However, there are some significant changes to the 1095C Of course, depending on how these changes impact your reporting on 1095C, your reporting on the 1094C may also change We offer eFiling for 13 through tax forms! Form 1095C This tax form is normally sent to employees by their employer prior to January 31 each year IRS Notice 76 (page 6, paragraph A) extends the deadline to provide the form by Form 1095C for federal civilian employees paid by DFAS and military members will be available on myPay NLT January 31

The New 1095 C Codes For Explained

Do i need form 1095-c for 2020 taxes

Do i need form 1095-c for 2020 taxes- You do not have to enter a 1095C in TurboTax You will answer the question in the Health Insurance section that you had health insurance all year and keep a copy of the 1095C with your tax records The insurance company will provide the IRS with the needed information 0 AM This final rule went into effect on and became applicable to plans starting in January Without further ado, a breakdown of the new codes to be entered on Line 14 of the 1095C Form as provided in the new IRS draft forms 1L Individual coverage health reimbursement arrangement (HRA) offered to an employee with the

1095 C Form 21 Finance Zrivo

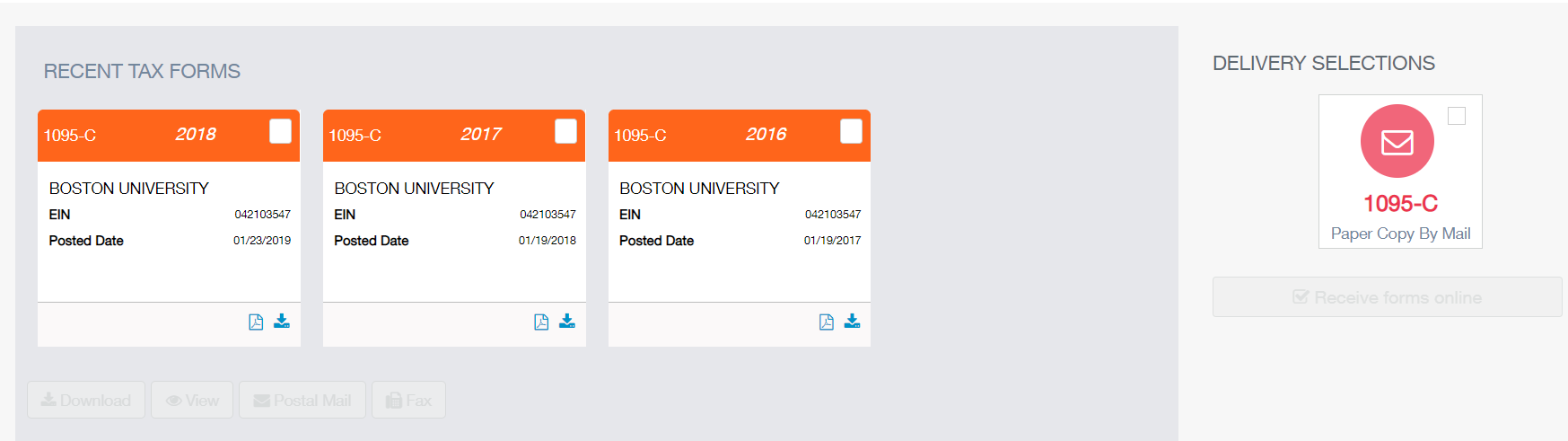

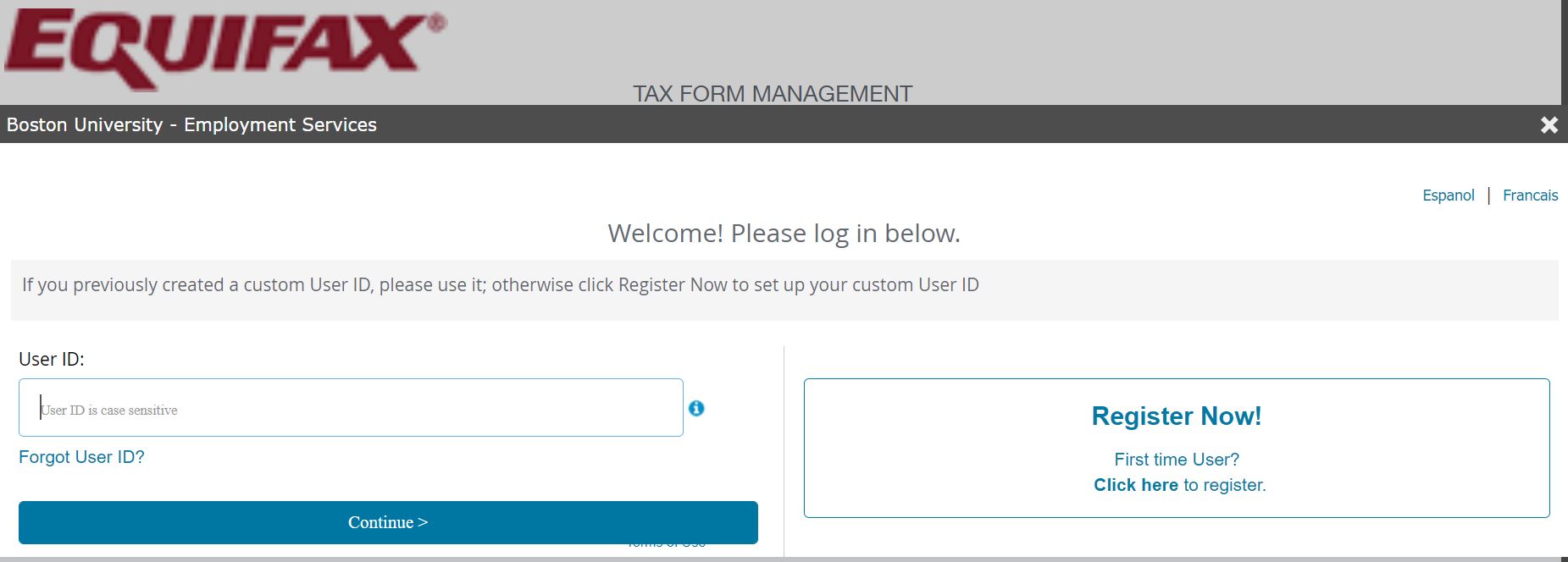

Your 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part of the Patient Protection and Affordable Care Act Employees enrolled in the Boston University Health IRS Form 1095C provides information about the offer of health insurance coverage if you were a fulltime employee of an Applicable Large Employer (ie employers with 50 or more fulltime equivalent employees) at any time duringYou should receive your 1095C for the tax year by no later than If you believe you should have received a 1095C but did not, please contact HR Services at (814) What should I do with my Form 1095C?

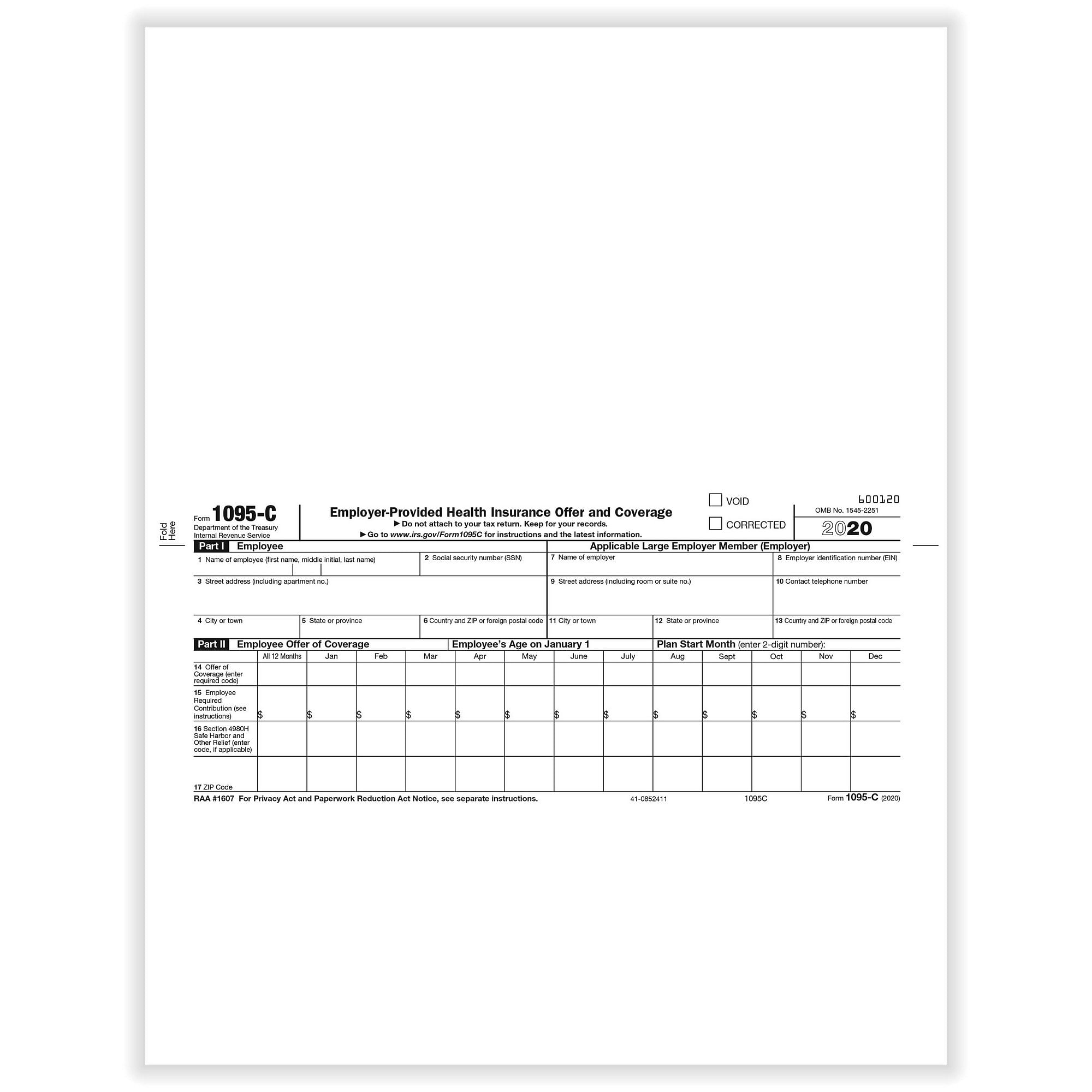

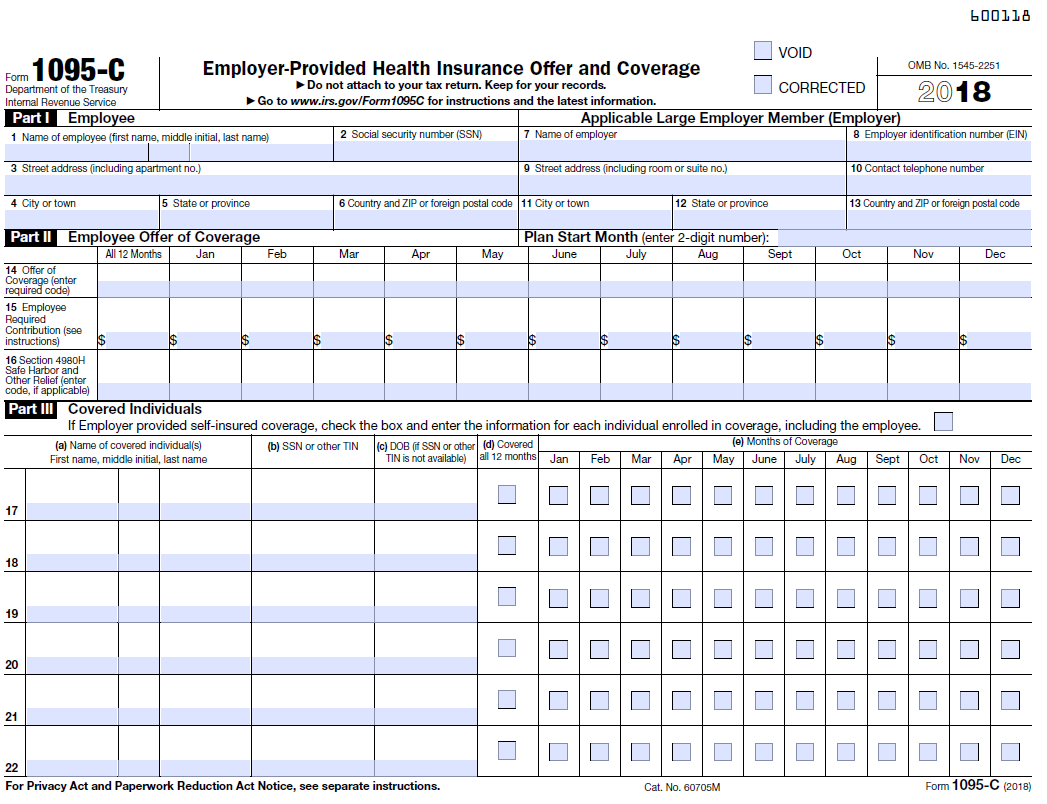

CODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses thisForm 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No Part I Employee 1 Name of employee (f In late February, the university will be mailing a tax form called the 1095C to faculty and staff, who may need this form when filing taxes for The form documents eligibility and/or enrollment in the JHU medical plans for This same information will be reported to the IRS The form is not required to be attached to the form 1040

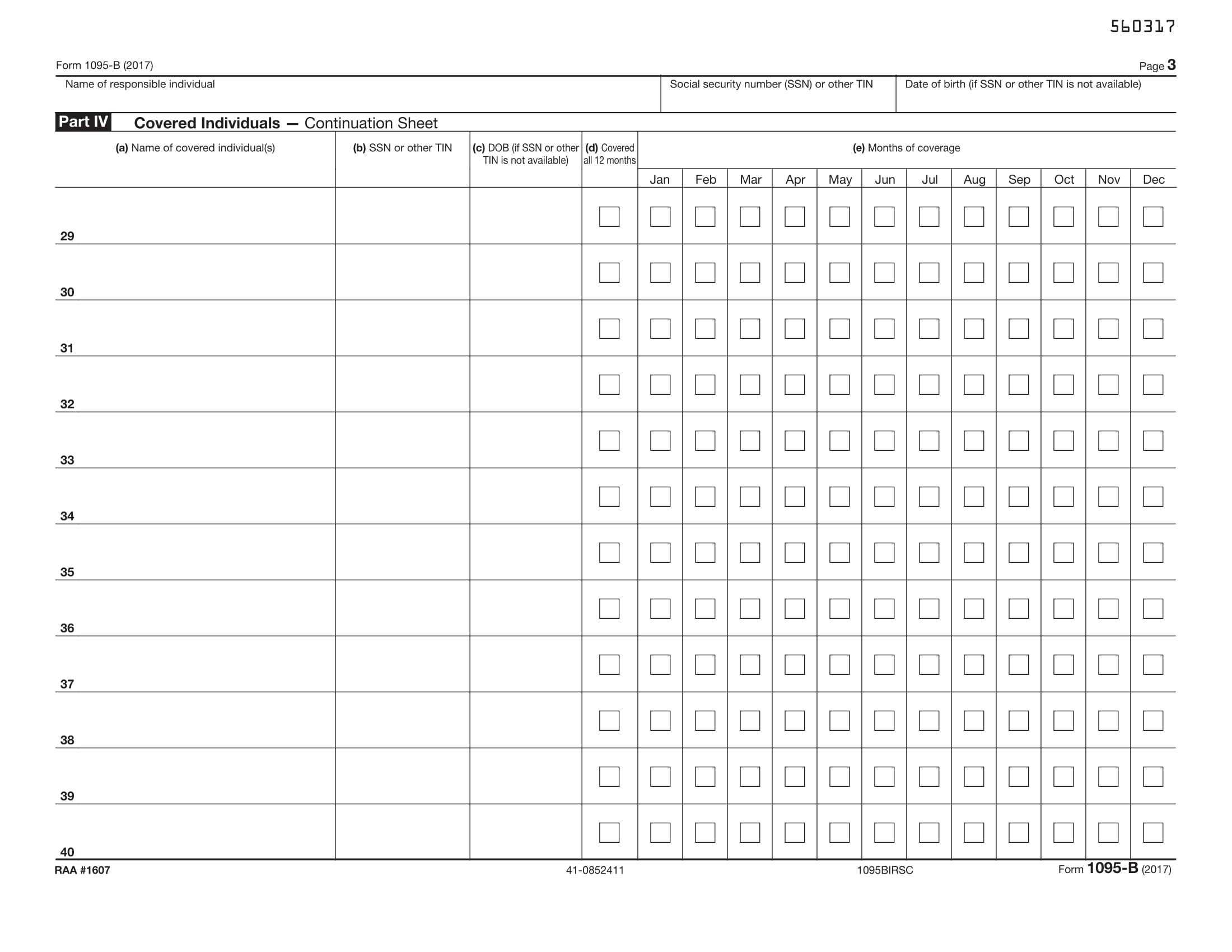

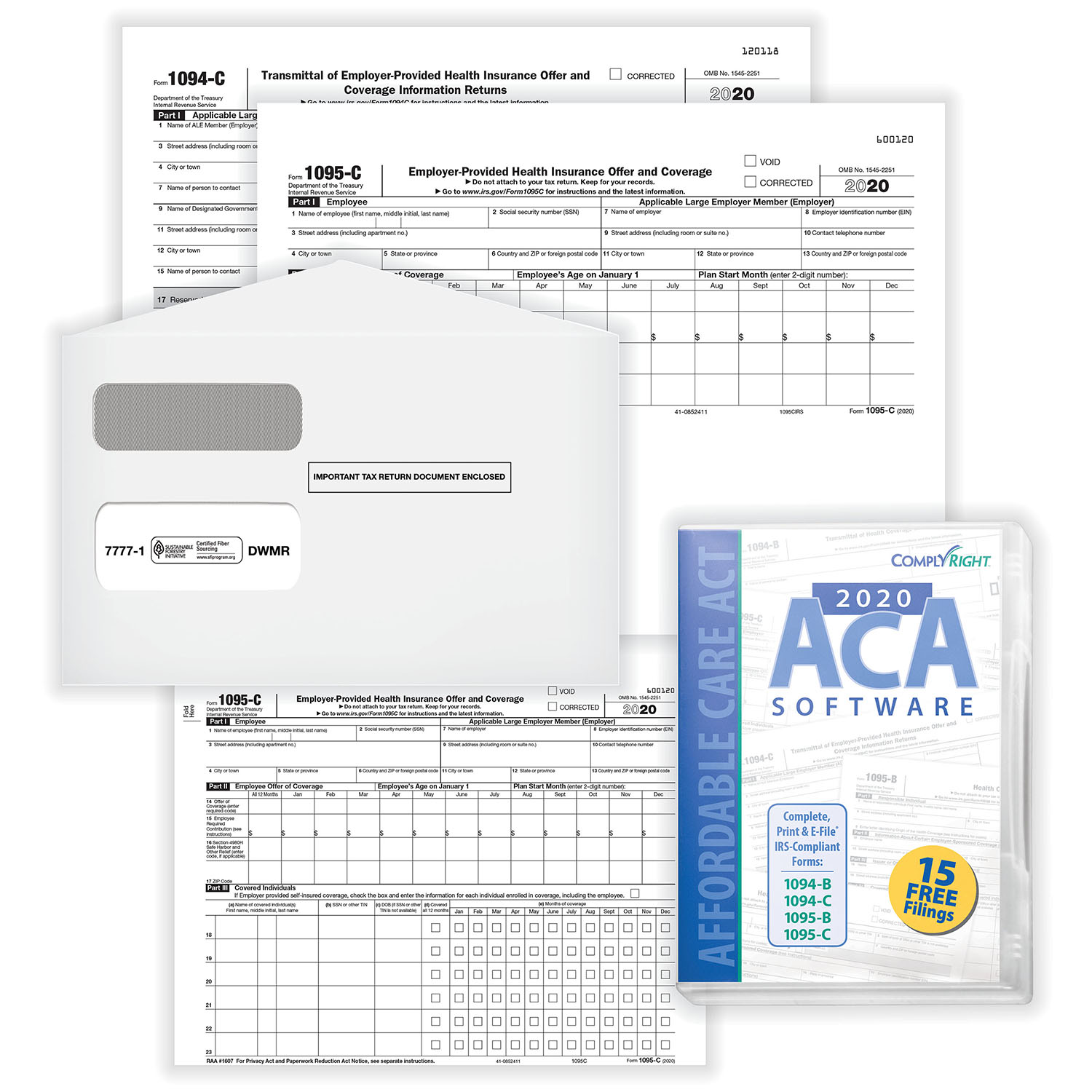

However, the IRS extended the deadline for employers from to Will I receive multiple forms? Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is issued by large employers required to offer coverage to employees This form reports both Offer of coverage to an employee Coverage of the employee if the employer is selfinsured and the employee enrolls in coverage However, just like with the 1095B, most Sample Excel Import File 1095C xlsx In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14 "Offer of Coverage" 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S New field, line 17 "Zip code"

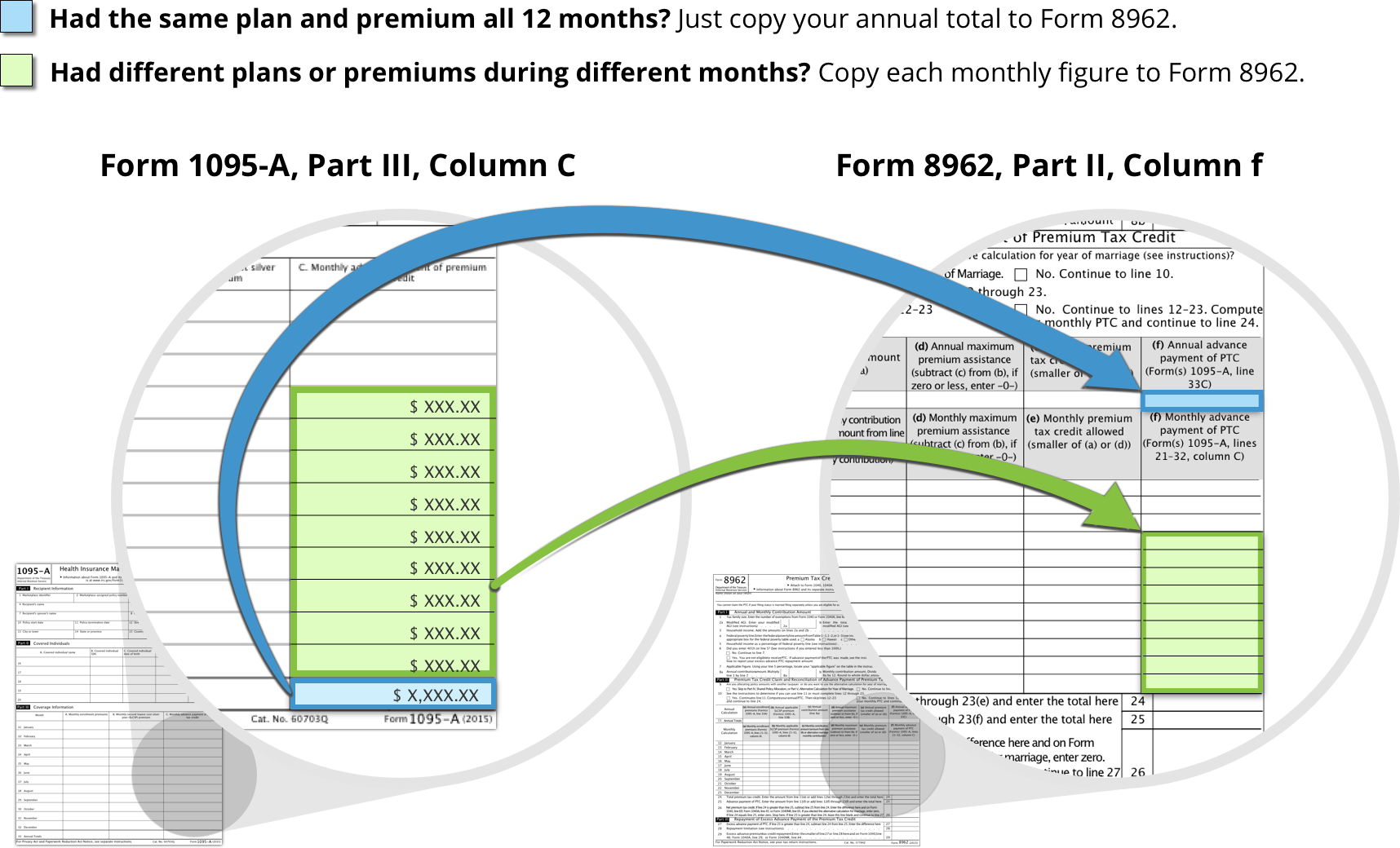

How To Reconcile Your Premium Tax Credit Healthcare Gov

The New 1095 C Codes For Explained

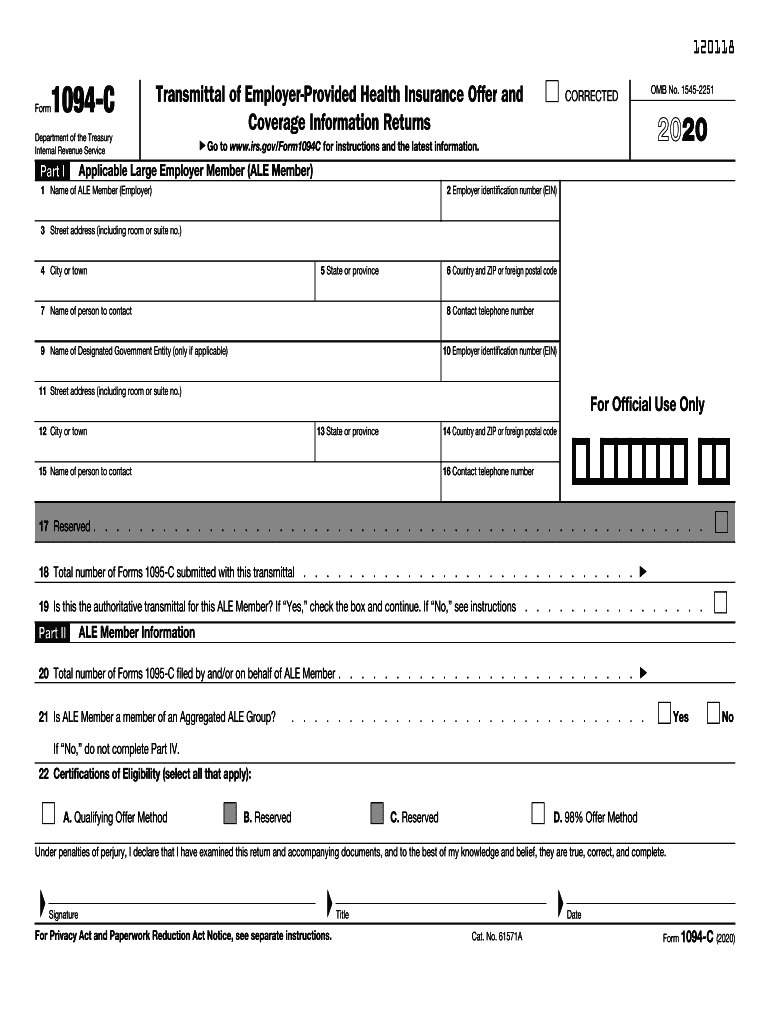

Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover The bottom line is Form 1095C is the tax form that reports your health coverage offered by your employer This is due to an Applicable Large Employer must offer you health insurance whether you take it or not Since this must be reported, you will be furnished with a 1095C providing you the information you can further use on Forms 1040

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Information about IRS Form 1095 for IRS Form 1095 provides information about your medical coverage as required by the Affordable Care Act (ACA) Employers and/or health plans prepare and send these forms annually; Form 1095C is not required to file your tax return Mon, In late February 21, the Health Care Authority (on behalf of your employer) will mail Forms 1095C to state agency, highereducation, and commodity commission employees enrolled in Uniform Medical Plan (UMP)Tax Year Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Code Cheatsheet

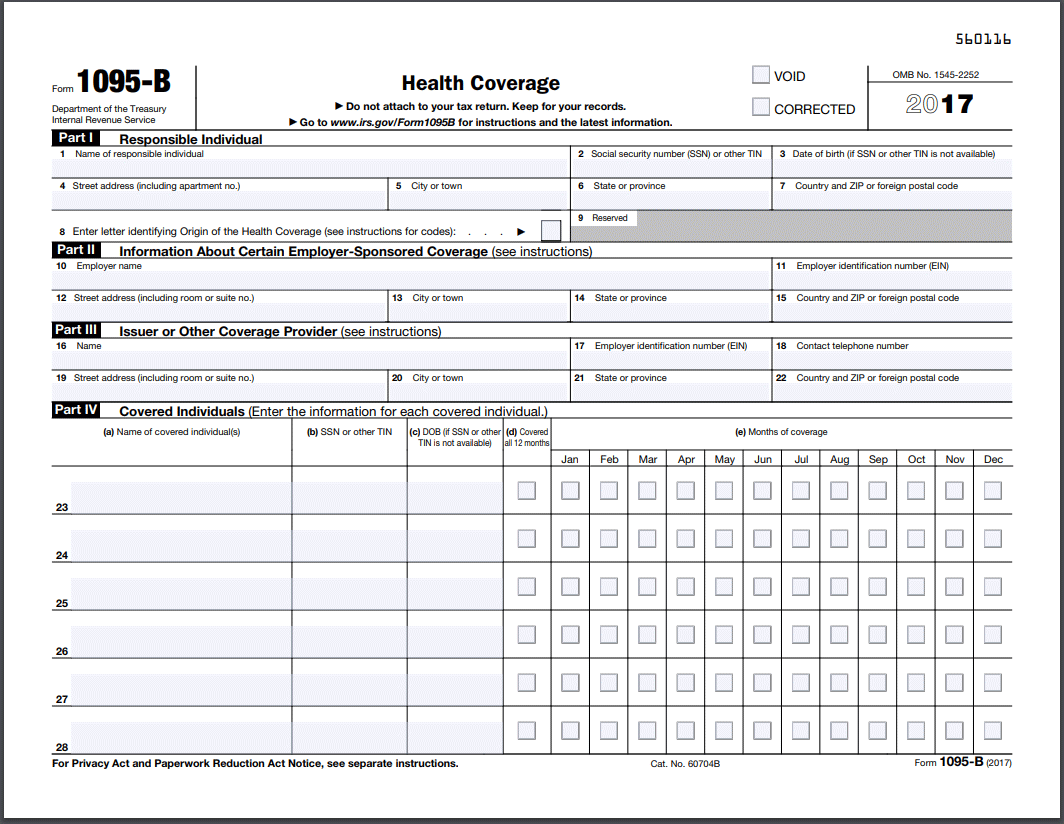

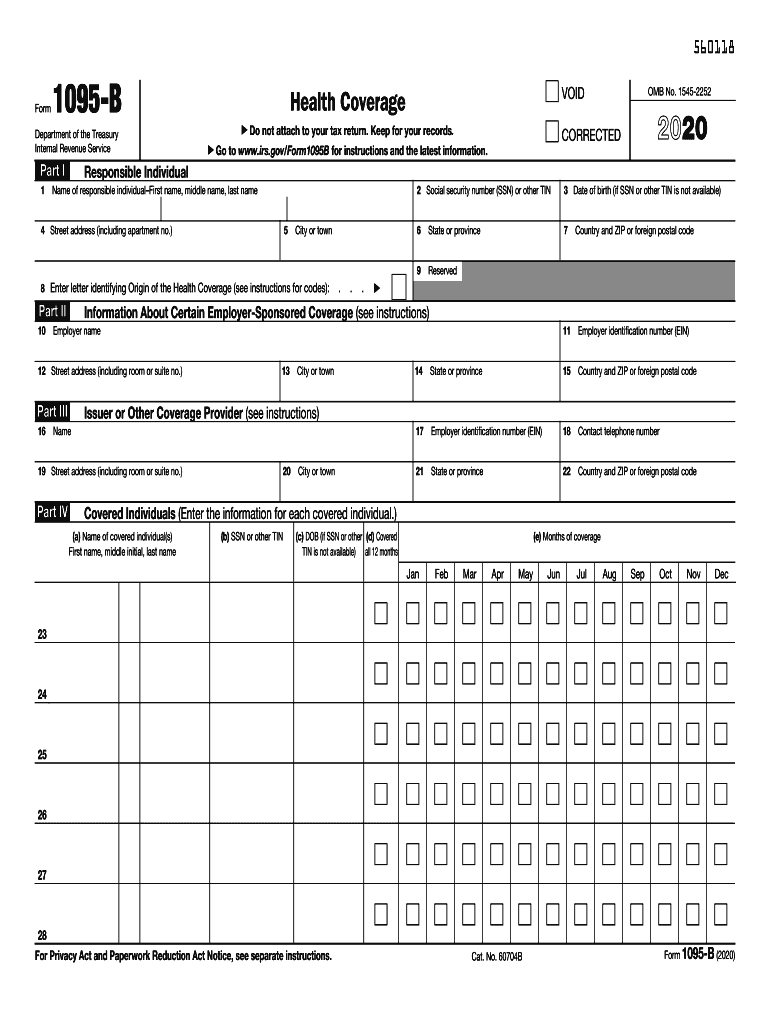

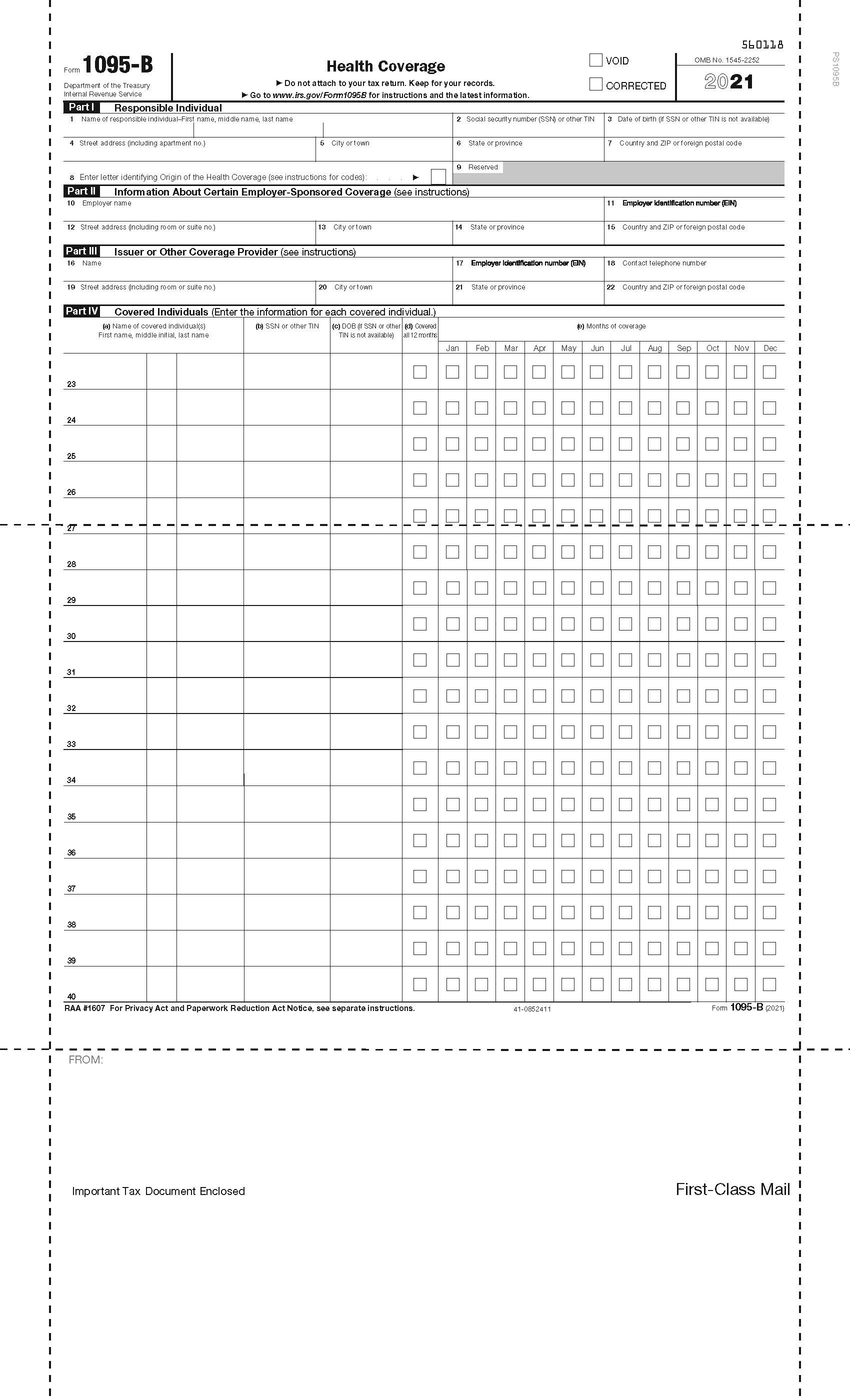

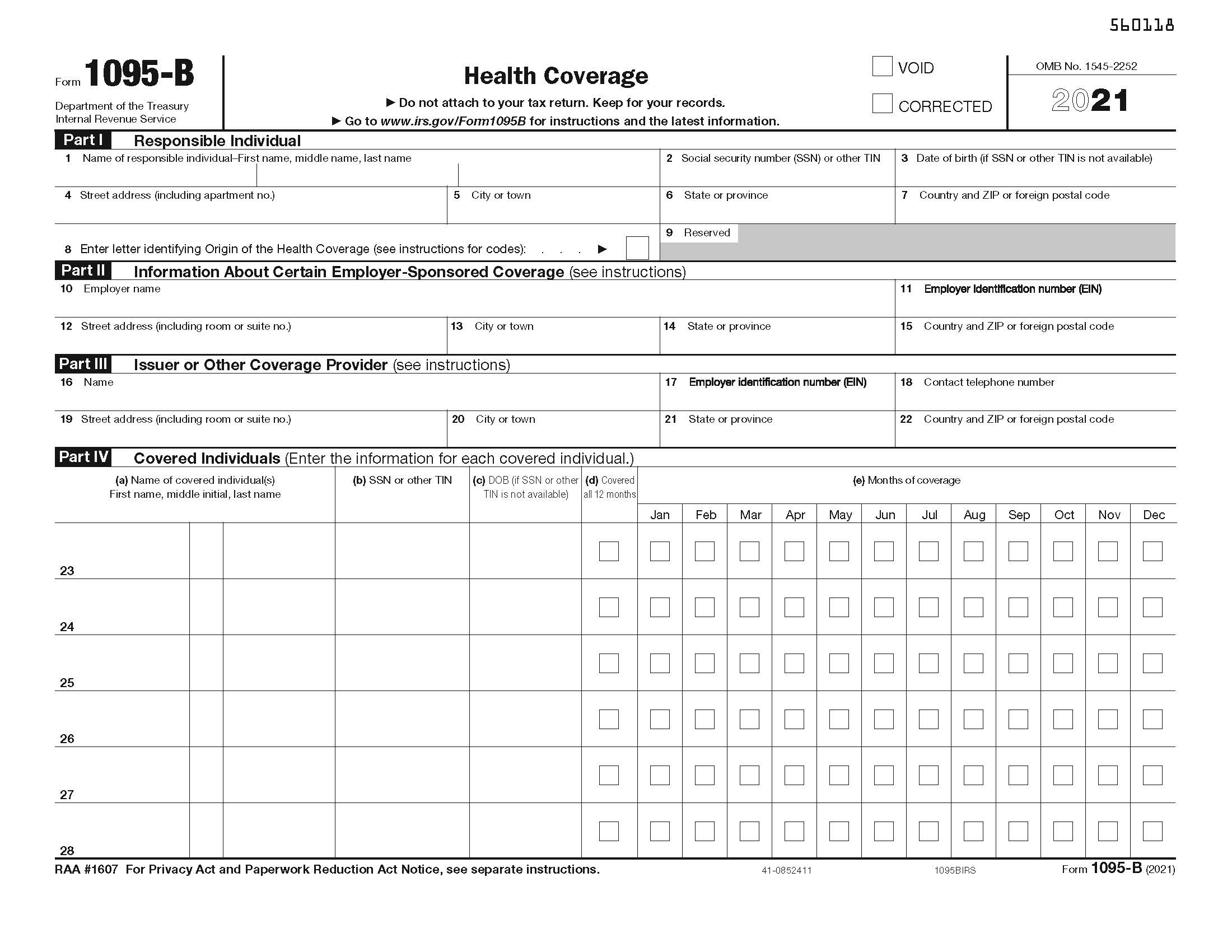

Form 1095B If your company is not an Applicable Large Employer (ALE) under the federal Affordable Care Act rules but it is selfinsured, the California reporting requirement does apply to your company In this situation, you may be required to complete the 1095B form (which you should already be doing), not the 1095C form1095C TAX FORM Part of the ACA legislation requires that Krause Group and all related companies to provide employees that were eligible for health care coverage in with a 1095C tax form The deadline for employers to provide the 1095C tax form The IRS also extended transition relief from penalties for incorrect or incomplete information under Sections 6721 and 6722 to ALEs that can demonstrate that they made goodfaith efforts to comply with the Form 1095C reporting requirements under Section 6056 for ;

2

1095 C Faqs Mass Gov

You can import your forms from Excel, or key them in, and have them printed & mailed by The 1094B & 1094C summary transmittals will be filed by our SSAE 18 SOC I Type II secure Service Bureau byMembers on an ASO/SelfInsured Commercial Health Plan receive Form 1095C from their Employer You do not have to wait for either Form 1095B or 1095C from your coverage provider or employer to file your individual income tax return You can use other forms of documentation, in lieu of the Form 1095 information returns to prepare your tax returnBoth for furnishing to individuals and for filing with the IRS

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

ACA Form 1095C Filing Instructions An Overview Updated 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employees IRS 1095B Tax Form Update Starting with the 19 tax year, the federal penalty or fine for not having health insurance, no longer applies The Wisconsin Department of Health Services (DHS) is not sending out IRS 1095B tax forms to members However, if you wish to, you can request this form How to request a 1095B tax form Form 1095c Received after taxes were filed What do I do?

1095 C Reporting Determining A Company S Ale Status Integrity Data

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Form 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxActFor calendar year , Forms 1094C and 1095C are required to be filed by , or , if filing electronically See Furnishing Forms 1095C to Employees for information on when Form 1095C must be furnishedIn the coming weeks, you may receive a tax document called the 1095C that will contain detailed information about your healthcare coverage if you were eligible in While you will not need to include your 1095C with your tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return

Form 1095 C H R Block

Questions Employees Might Ask About 1095 C Forms Bernieportal

Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21 Employers have until the end of February to send them to the IRS if filing paper forms, or until the end of March ifStarting with 19 tax returns (filed in early ), there will no longer be a penalty for not having insurance, but forms 1095A and 1095C will still be filed by the exchanges and employers, so that premium subsidies can be reconciled on tax returns Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes"

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Www Opm Gov Healthcare Insurance Fastfacts Health Coverage Forms Fast Facts Employees Pdf

Keep your Form 1095B with your other important tax information, like your W2 form and other tax records You don't need to Take any immediate action Send this form to the IRS when you file your taxes Send this form back to Medicare If you had health coverage other than Medicare during the past tax yearForm 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17 Form 1095C EmployerProvided Health Insurance Offer and CoverageALEs are required to send Form 1095C to all fulltime employees as defined by ACA (those who work an average of 30 or more hours per week in any given month) Accordingly, Form 1095C will be mailed to anyone who was a fulltime equivalent employee during

1

1

1095C Tax Form for Before eligible employees will receive a Form 1095C tax document, which reports information about your medical coverage in While you will not need to include your 1095C with your tax return filing, or send it to the IRS, you may need information from your 1095C to help complete your tax returnProduct Number Title Revision Date;Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Inst 1094C and 1095C Instructions for Forms 1094C and 1095C

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Your Tax Forms W 2 And 1095 C One Spirit Blog

@ Hugger1975 The IRS says to allow 48 weeks to process a return after receiving the 1095A and Form 62, although I have seen them processed much quicker than thatThere is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21ACA Online Filing We file 1095B forms online and file 1095C forms online!

Info Nystateofhealth Ny Gov Sites Default Files English aptc cover letter Pdf

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

1095C I think I'm getting fined I have Covered California from July to Dec (1095A Form), my previous employer sent me 1095C for Jan to May but there is no where I can enter on Turbo Tax I heard if you don't have health insurance for 3 months you are finedWhen you receive your 1095C, keep it for your records Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

Form 1095 C Instructions Line By Line 1095 C Instruction Explained

1099 Misc Form Copy C 2 Recipient State Zbp Forms

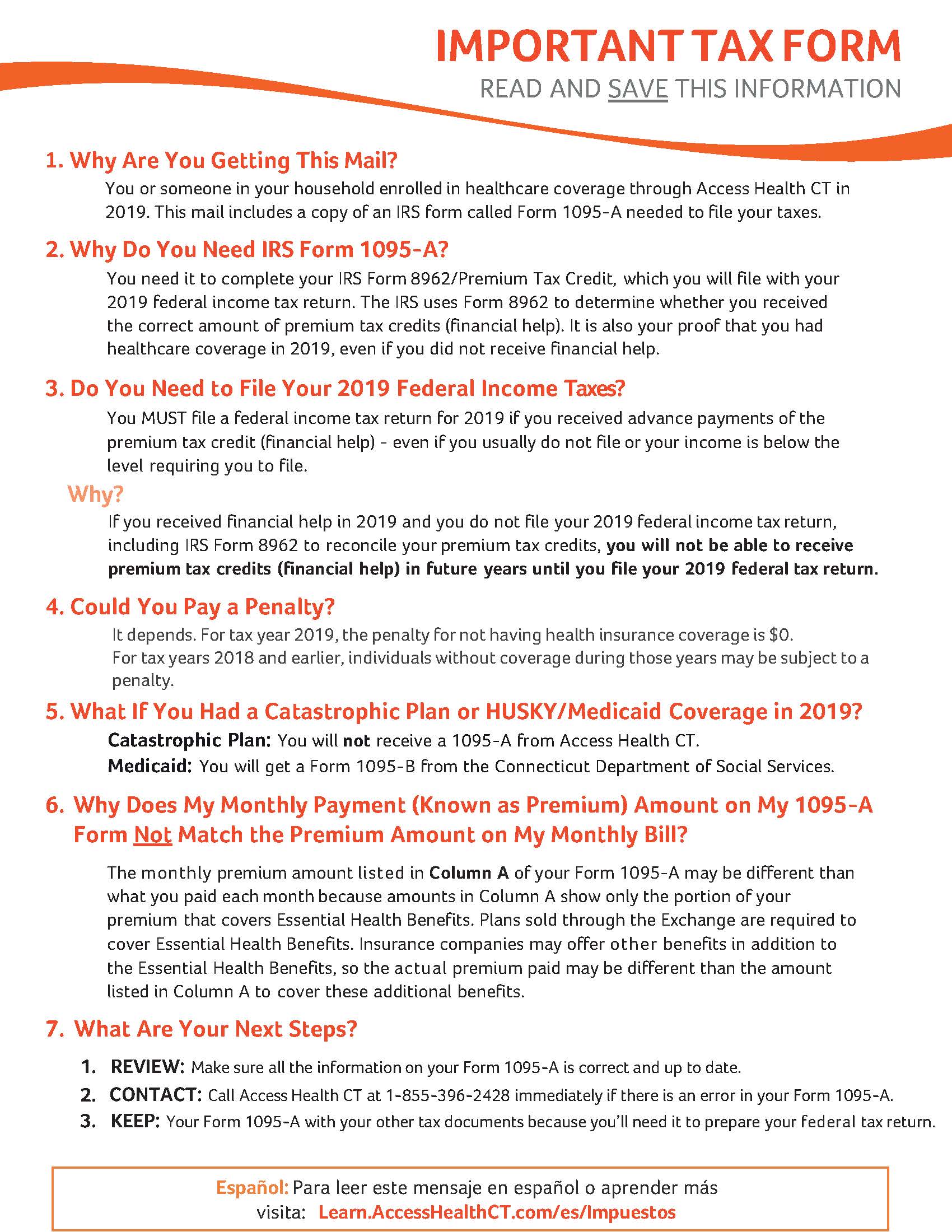

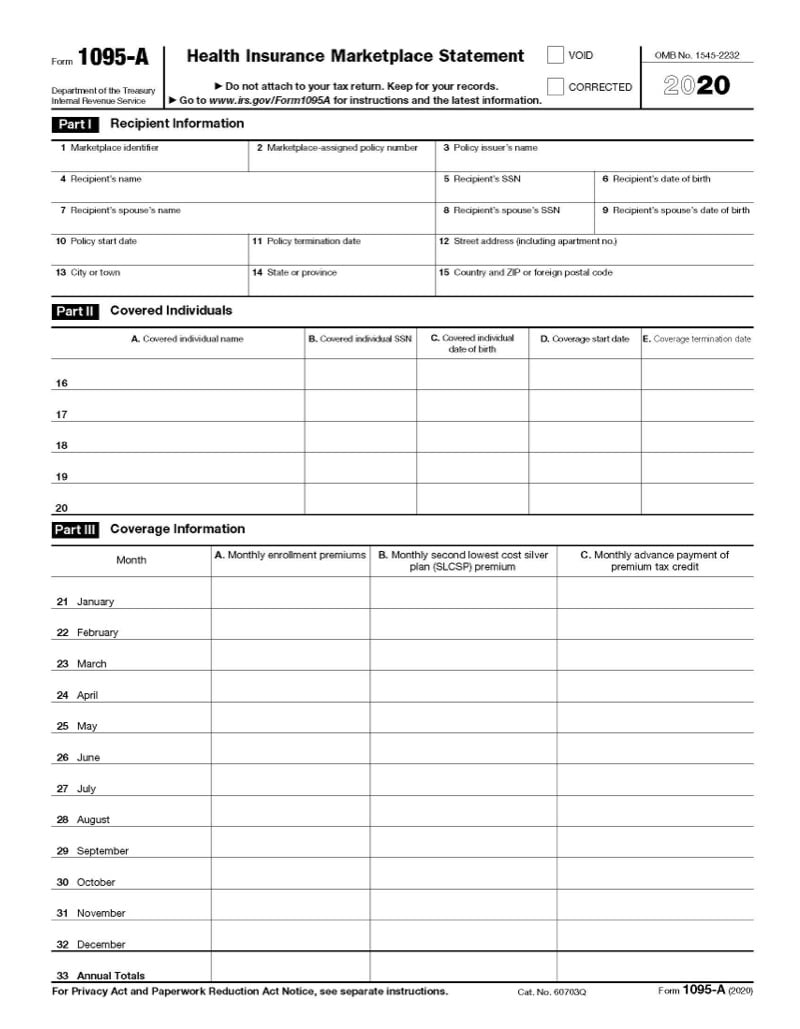

Don't file your taxes until you have an accurate 1095A Your 1095A includes information about Marketplace plans anyone in your household had in It comes from the Marketplace, not the IRS Keep your 1095As with your important tax information, like W2 forms and other records How to find your 1095A online

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Aca Software Hrdirect

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Www Opm Gov Healthcare Insurance Fastfacts Health Coverage Forms Fast Facts Annuitants Pdf

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Instructions For Forms 1095 C Taxbandits Youtube

Irs 1094 C 21 Fill Out Tax Template Online Us Legal Forms

1095 C 18 Public Documents 1099 Pro Wiki

How To Obtain W 2 1095 C Statements Postal Times

Aca Forms

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Www Schoolcare Org Uploads Files Video Transcript Irs Reporting Updates Part 2 Pdf

Www2 Illinois Gov Cms Benefits Stateemployee Documents 1095 Faqs Pdf

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

1

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

19 Aca Reporting Timeline Pomeroy Group

Coming Soon Irs Form 1095 For 19 Ucpath

Form 1095 C Forms Human Resources Vanderbilt University

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Oklahoma Gov Content Dam Ok En Omes Documents Faq Irs1095creporting Pdf

Employeeservices Sccgov Org Sites G Files Exjcpb531 Files Documents 1095 C Attachment Faq Pdf

Affordable Care Act Aca Forms Mailed News Illinois State

Tax Information Access Health Ct

Instructions For Forms 1095 C Taxbandits Youtube

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

News 1095 C Tax Form Coming Soon

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

2

2

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

2

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

It S Tax Time Be On The Lookout For Your W 2 And 1095 Forms

Hr Jhu Edu Wp Content Uploads 19 06 Aca 1095faq Pdf

Irs Reporting Under The Affordable Care Act Bkd Llp

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Tax Form 1095 A Frequently Asked Questions

Www Utdallas Edu Hr Download Irs Form 1095 C Faq Pdf

Your 1095 C Tax Form For Human Resources

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Aca Forms

2

Aca Forms

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Employer Deadline To Furnish Forms 1095 B C To Plan Participants Extended To March 2 Sequoia

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Plan Now For How You Will Receive Your Tax Forms Montgomery County Public Schools

Www Ftb Ca Gov Forms 35c Publication Pdf

Updates To Form 1095 C For Filing In 21 Youtube

2

2

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

1095 C Form 21 Finance Zrivo

1

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

1095 C Tax Forms Cwi

Affordable Care Act Form 1095 C Form And Software Hrdirect

Mark These Dates For 19 Aca Reporting Update The Aca Times

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Your 1095 C Tax Form For Human Resources

Irs Issues Deadline Extension For Furnishing Forms 1095 C The Aca Times

Aca Forms

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Draft Irs Reporting Forms Released

2

2

Office Depot

Employees Will Soon Receive Tax Forms W 2 1095 C And 1042 S News Illinois State

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

1095 C Form 21 Irs Forms

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

0 件のコメント:

コメントを投稿