The 21 General Instructions for Certain Information Returns, and The 21 Instructions for Form 1099B To order these instructions and additional forms, go to wwwirsgov/Form1099B Caution Because paper forms are scanned during processing, you cannot file Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS websiteDue dates Furnish Copy B of this formMy preprinted 1099 Copy A Copy B and Copy C all have identical a top and bottom forms but my software only prints on the top form 1 Is this correct?1099c copy b Reap the benefits of a digital solution to develop, edit and sign documents in PDF or Word format on the web Convert them into templates for numerous use, insert fillable fields to collect recipients?

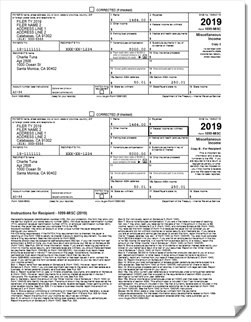

1099 Nec Form Copy B Recipient Zbp Forms

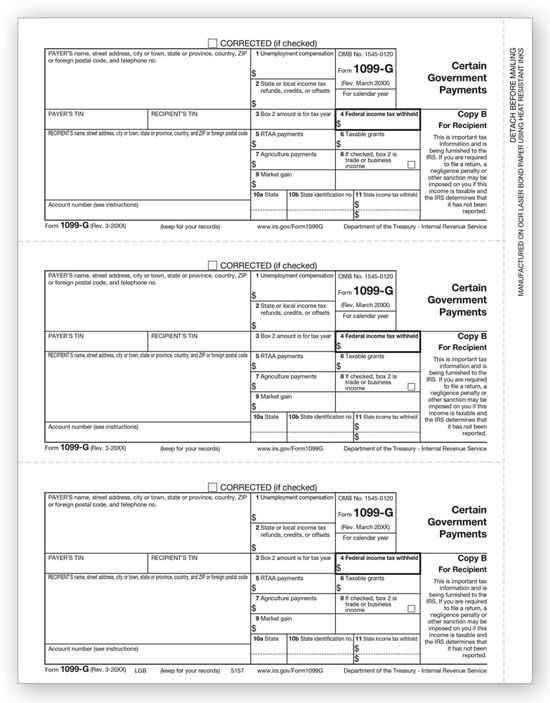

1099-g copy b for recipient

1099-g copy b for recipient- Instead, you must obtain a physical Form 1099NEC, fill out Copy A, and mail it to the IRS Learn how to get physical copies of Form 1099MISC and other IRS publications for free 3 Submit copy B to the independent contractor Once your Form 1099NEC is complete, send Copy B to all of your independent contractors no later thanAP_COPY_B Report (Print 1099 Copy B) (Step #26) Review, Print, & Send Copy B Documents (Step #27) Send IRSTAX001 File to IRS (Step #28) Run Process WTHD_SENT (Withholding Sent File ) (Step #29) End 1099 Process Are you making manual adjustments?

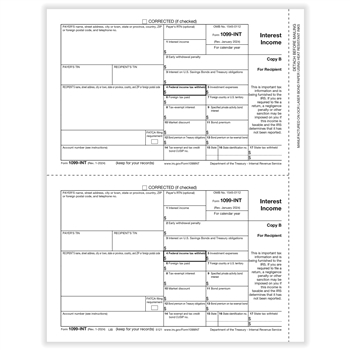

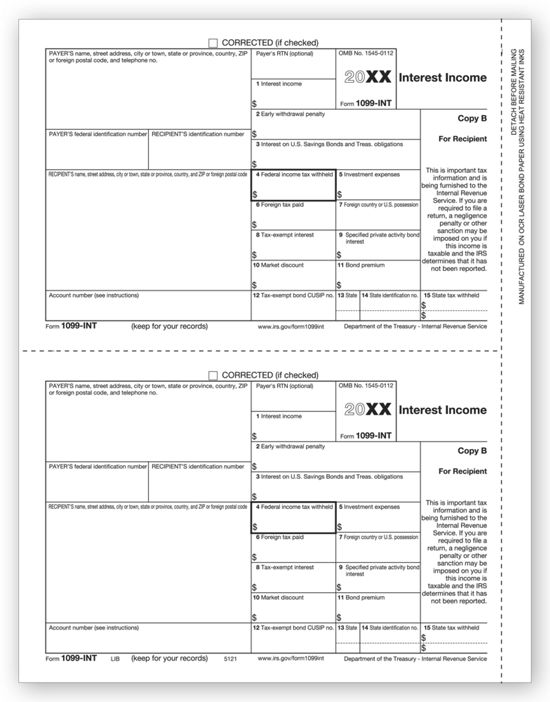

Form 1099 Int Interest Income Recipient Copy B

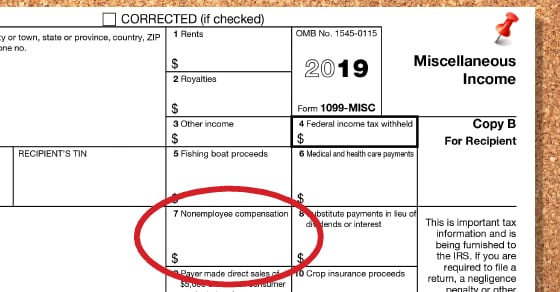

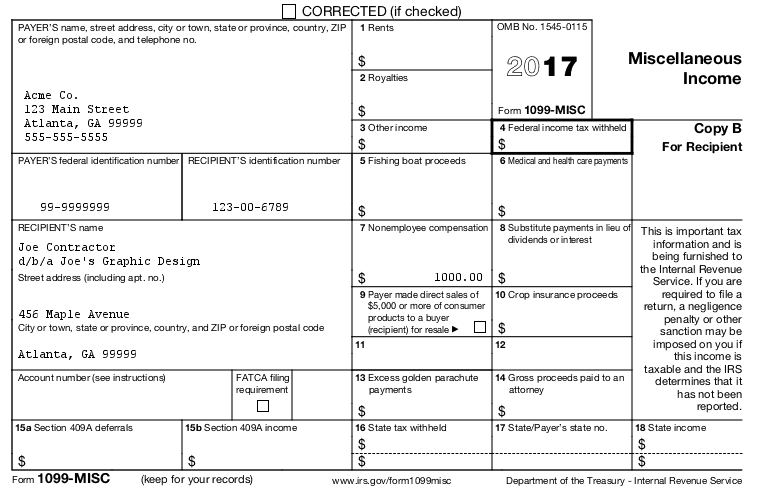

Copy B is sent to the payee Here we provide tips on preparing Copy B statements to recipients or payees There is no time extension for distributing Copy B Copy B must be sent to the payee on time Postmark the letter on or before the due date You can also email, fax or just print out Copy B and hand it to the payee1099NEC Recipient Copy B Cut Sheet 1099NEC Recipient Copy B Cut Sheet Prev Next Report payments other than wages, tips and salaries, such as miscellaneous income, to nonemployees made in the course of a trade or business with 1099NEC forms The 1099 NEC The 1099MISC has Copy A, B, C, 1 and 2 Copy A is sent to the IRS along with the 1096 Copy B is sent to the recipient and the recipient keeps that copy The payer or the business issues the 1099MISC forms to vendors/contractors should retain Copy C

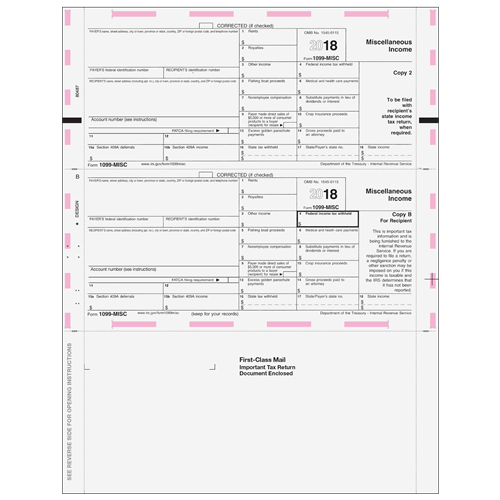

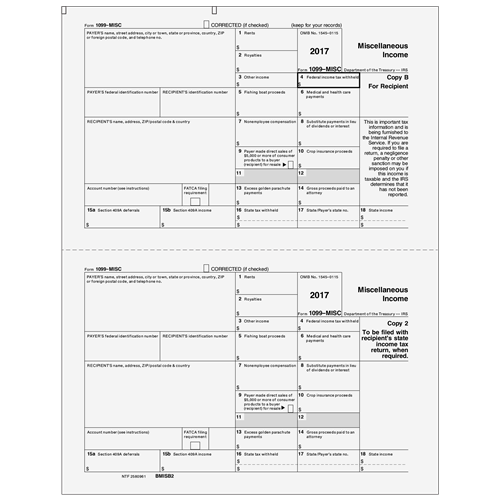

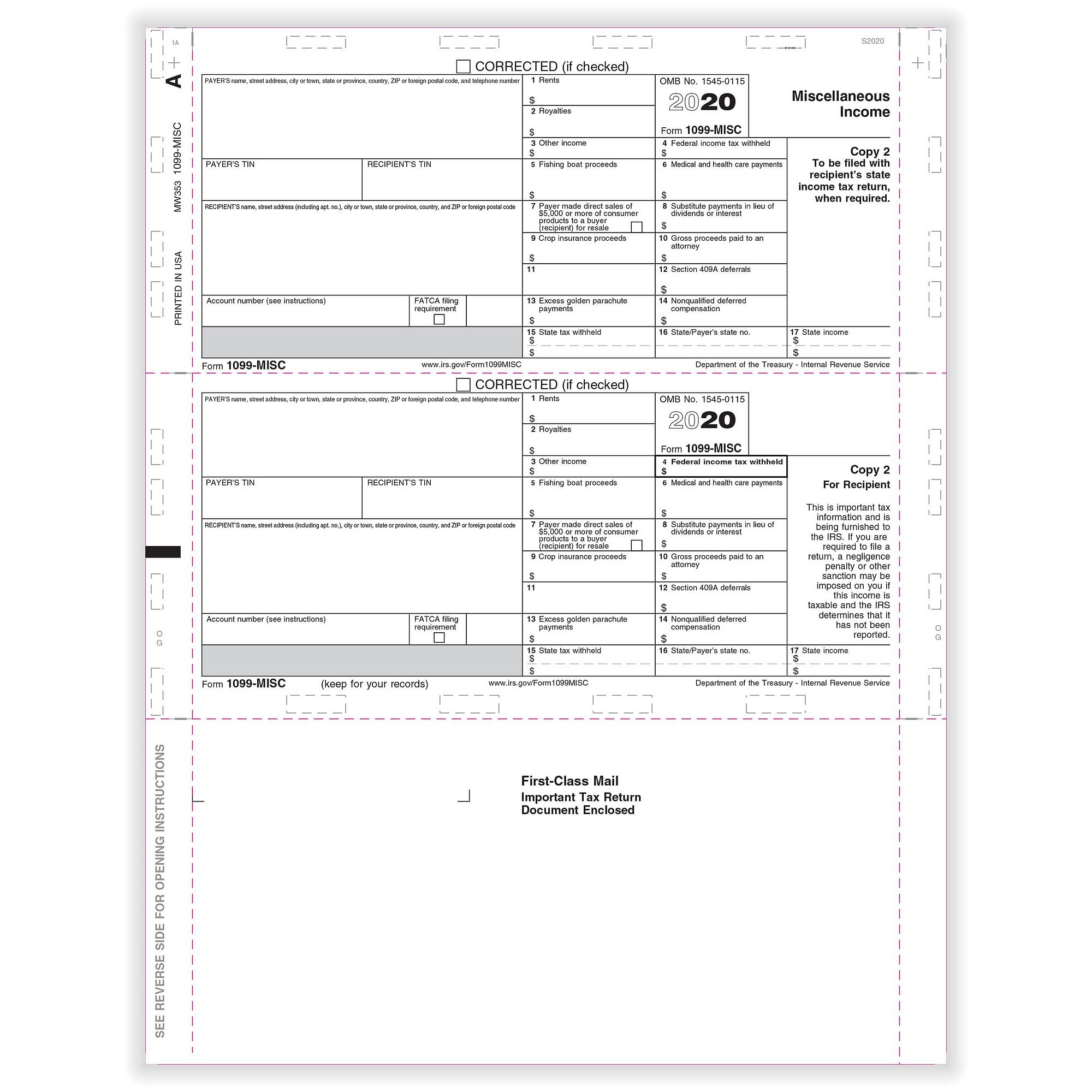

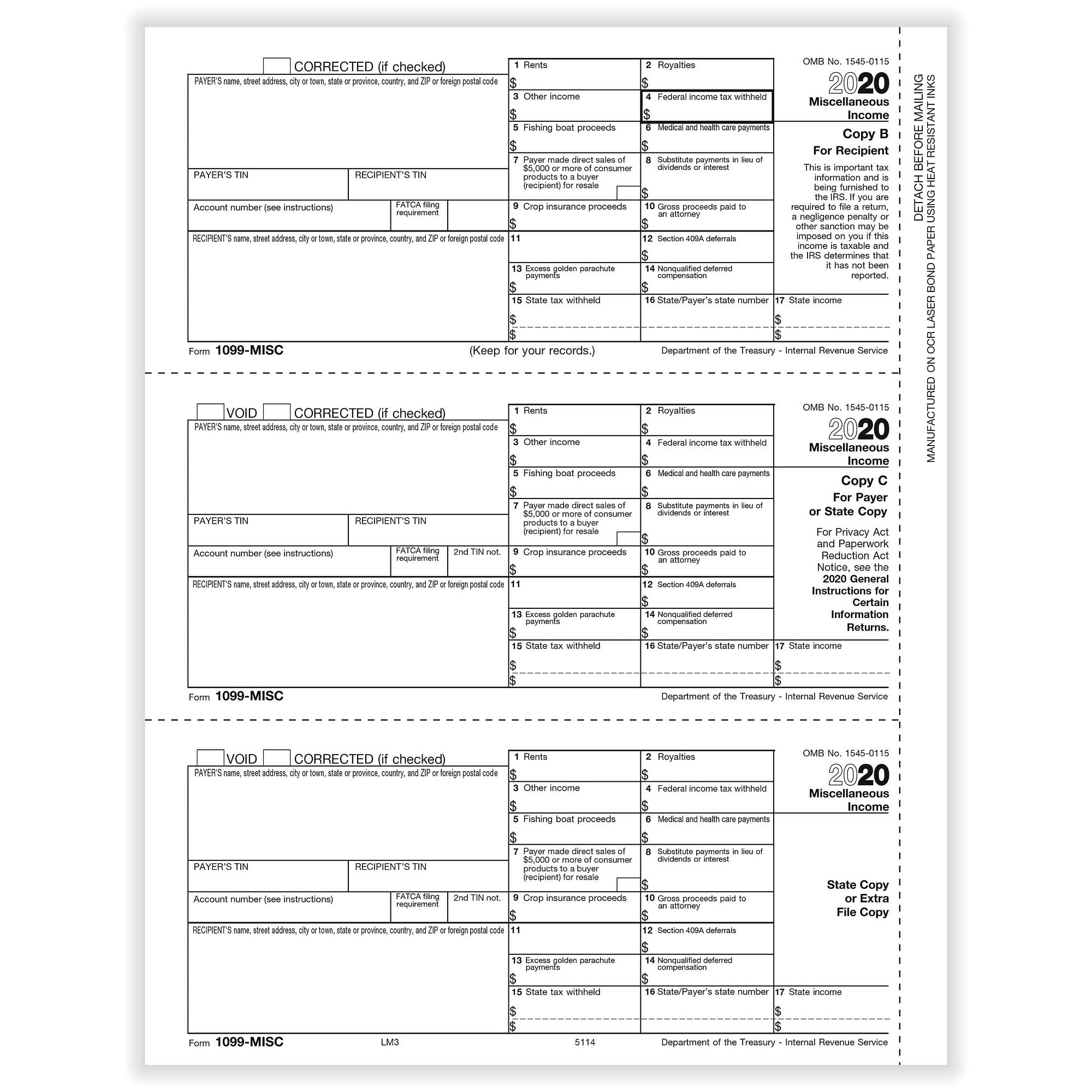

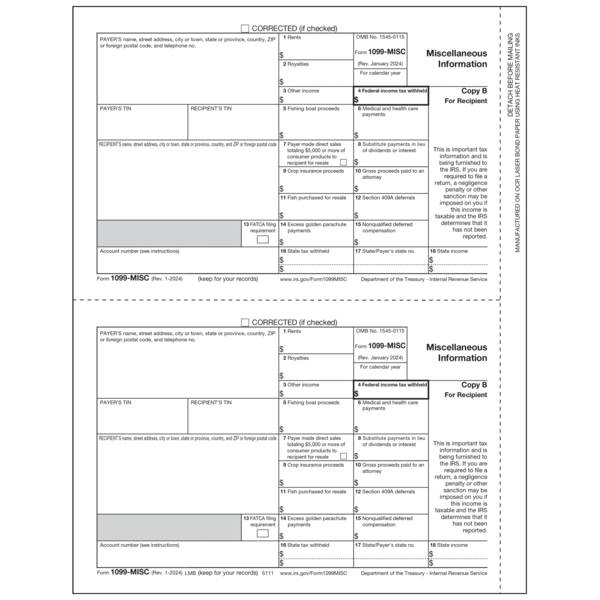

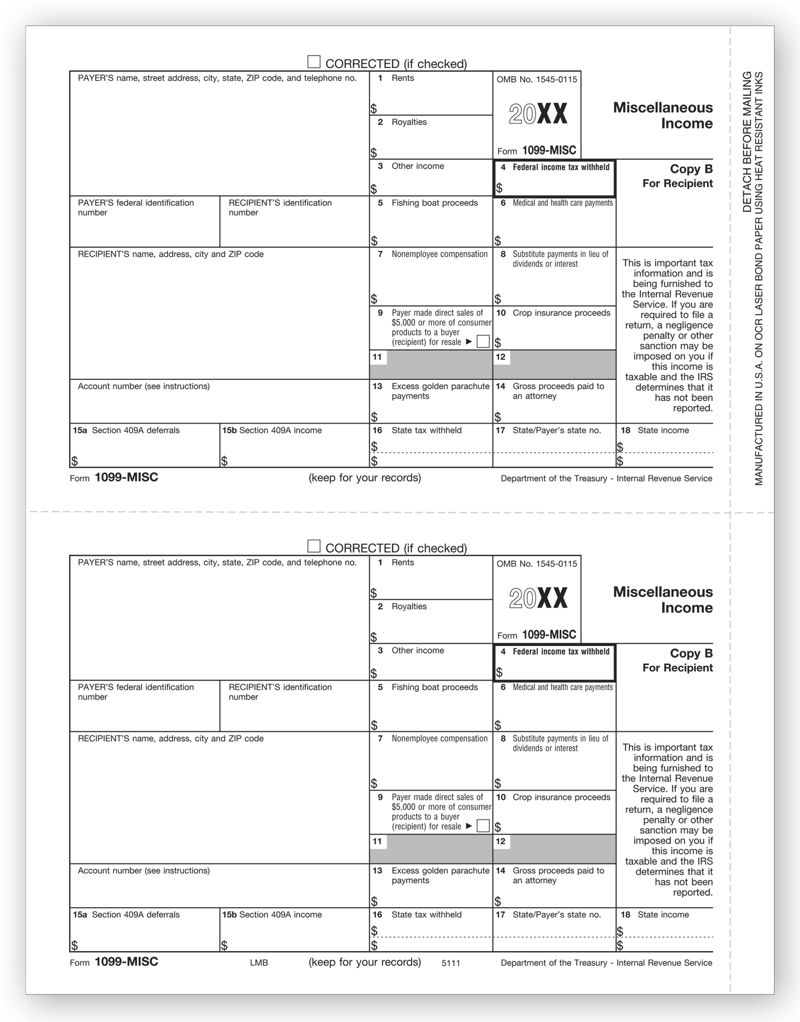

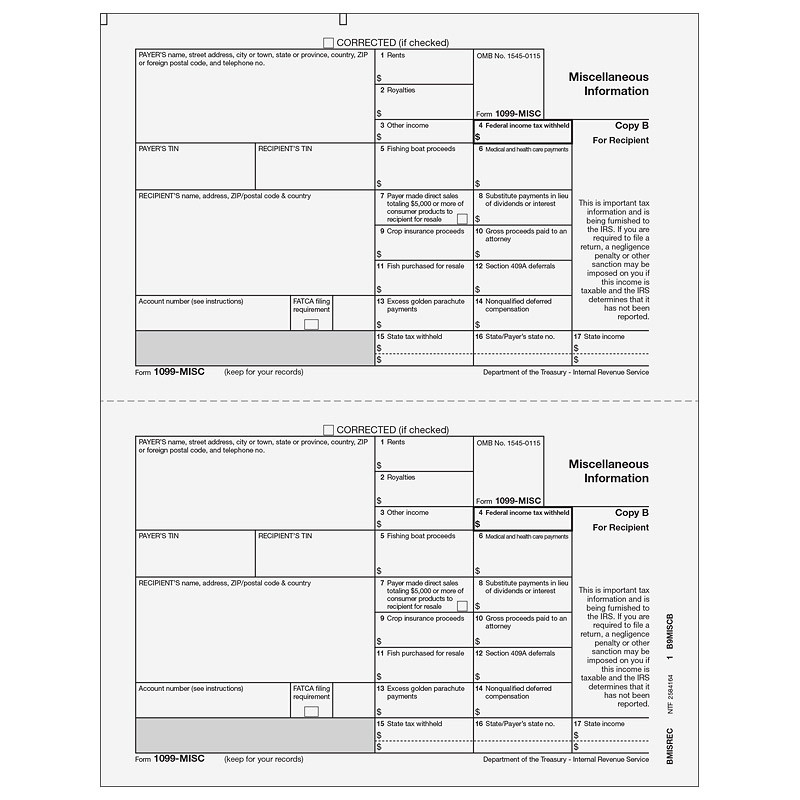

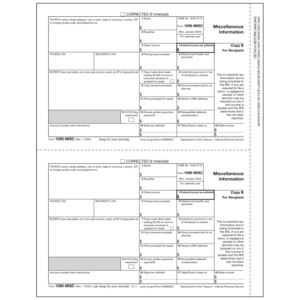

1099MISC Tax Forms – Recipient Copy B Copy B forms for payers to mail to the recipient Use 1099 Miscellaneous Forms to report miscellaneous payment of $6001099NEC 3Up Individual Recipient Copy B • 3Up Copy B for Recipients' records • Laser cut sheets • Printed with heatresistant ink for use with most inkjet and laser printers • 1 page equals 3 forms • Comes in pack sizes of 25, 100 and 1000 forms •Official 1099B Forms Use the 1099B Copy B to print and mail payment information to the recipient (payee) for submission with their federal tax return

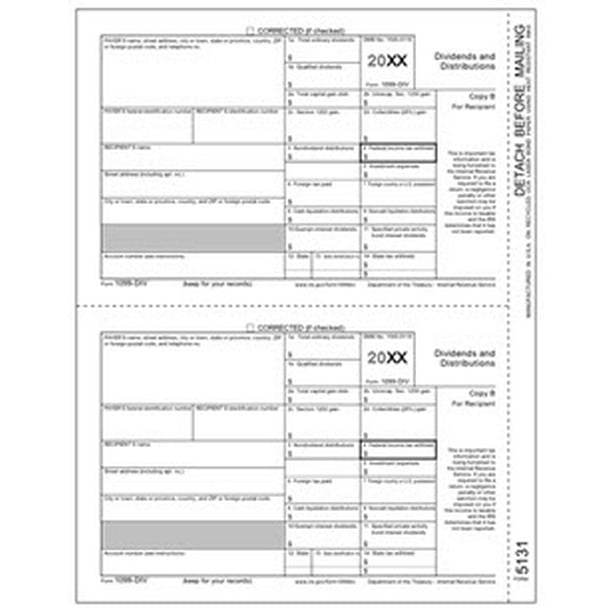

AP_COPY_B Report (Print 1099 Copy B) Review, Print, & Send Copy B Documents Send IRSTAX001 File to IRS Run Process WTHD_SENT (Withholding Sent File) End 1099 Process Are you making manual adjustments?1099DIV PrePrinted format This template prints two forms on each page (2UP), without Recipient instructions This is a copy of the "Copy B" that the IRS provides This template prints with just data printed without any boxes 1099INT PrePrinted format This template prints three forms on each page (2UP), without Recipient instructionsForm 1099MISC Copies of the form Our 1099 EFile service steps you through creating, printing or emailing, and efiling copies of Form 1099MISC required by the IRS and by your state Copy A is what we transmit electronically to the IRS Don't print this copy Print Copies B and 2 and mail

Form 1099 Misc Bhcb Pc

21 Laser 1099 G Payer And Or Borrower Copy B Deluxe Com

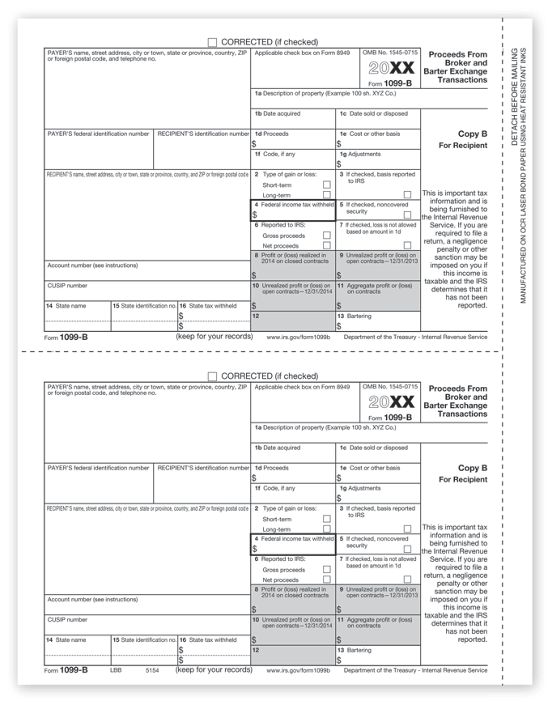

It's called Copy B and goes to the 1099 vendor These also print 2 vendors per page and you should separate the forms and mail to the vendor along with Copy 2 in the same envelope Next, there's copy 2 This one gets mailed to the vendor along with copy B in the same1099MISC Form Copy B Recipient Discount Tax Forms Product Details 1099MISC Tax Forms – Recipient Copy B Copy B forms for payers to mail to the recipient Use 1099 Miscellaneous Forms to report miscellaneous payment of $600 that are NOT NonEmployee Compensation (use 1099NEC forms to report payments to freelancers, contractors, attorneys, etc) If you sell stocks, bonds, derivatives or other securities through a broker, you can expect to receive one or more copies of Form 1099B in January This form is used to report gains or losses from such transactions in the preceding year People who participate in formal bartering networks may get a copy of the form, too

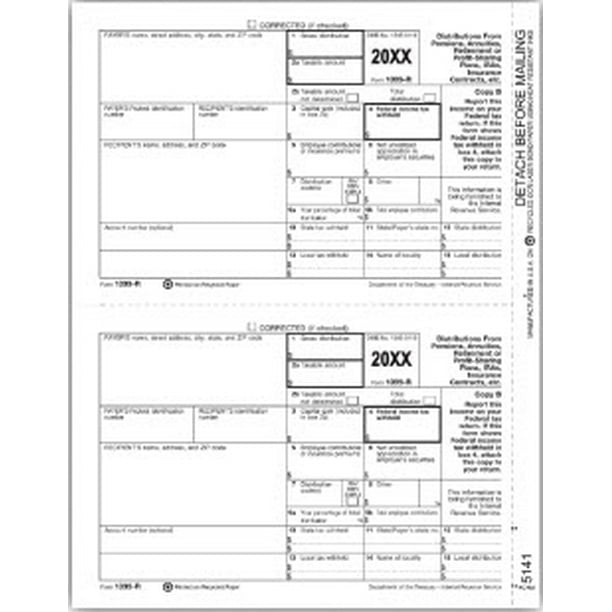

Tax Form 1099 R Copy B Recipient Condensed 4up 5175 Mines Press

1099 Misc Payer Copy C

Printable 1099 Form 21 Copy B – The 1099 form is used to report certain kinds of income a taxpayer has earned throughout the year The importance of a 1099 is that it's used to track the nonemployment earnings of tax payers A 1099 can be issued for dividends in cash received to buy stock, or to record interest income earned through the bank accountThe bottom say Void or Corrected I know where I send each copy A to IRS B torecipent and C for me the payer Soory my partner did this last timeThis W2 Mate tutorial shows users how to print QuickBooks 1099B forms Form 1099B for Proceeds from Broker and Barter Exchange Transactions is supported by our 1099B yearend printing software Copy QuickBooks 1099B data to W2 Mate with a simply import method Simply select your recipients, select the desired 1099B Copy, and press print

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

Tf5164 Laser 1099 Oid Copy B 8 1 2 X 11

Information, put and ask for legallybinding digital signatures Work from any gadget and share docs by email or fax Check out now?Starting in , a new Form 1099NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099MISC Singlepart Copy B tax forms Tax forms are inkjet and laser printer compatible Pack contains 25 1099NEC forms, one W3 and 1096 transmittal form Product dimensions 11"H x 85"WUse the 1099MISC Recipient Copy B to print and mail payment information to the recipient (payee) for submission with their federal tax return Miscellaneous Payments of $600 or more This form is fully compliant with our W2 Mate software and most other tax form preparation and IRS 1099 software products such as Intuit QuickBooks and Sage

Standard Register 10 Laser Tax Forms 1099 Misc 3 Up Copy B 50 Sheets Per Pack Sr Direct

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

What does it imply?1099MISC 21 Miscellaneous Information Copy B For Recipient Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that itForm 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) Inst 1099B

How To File 1099 Misc For Independent Contractor Checkmark Blog

Pressure Seal 1099 Misc Miscellaneous Income 11 Z Fold Recipient Copies B 2

Product Information Product Notes Description IRS Approved 1099 Miscellaneous Income form, Recipient Copy B Classic 2 on a page forms for sending to the recipient of funds Order by quantity of recipients needed After June 1st Tax form is for current Tax year Specifications Size 8 1/2" x 11" Form 1099MISCOn your Print 1099 Copy B pdf Www Csueastbay Form, rightclick on it and go to open with option From there, choose CocoSign reader to open the document Pick 'My Signature' and put your customized signatures Include it on the page where you require it Pick 'Done' 1099MISC Reprint of Copy B from Quick Employer Forms I'm not sure I trust what TurboTax says about their Quick Employer Forms If you enter data, it might disappear instead of being saved (as promised)

1099 Laser Dividend Recipient Copy B Item 5131

Amazon Com Egp 1099 Misc Recipient Copy B Irs Approved Laser Quantity 1000 Forms Recipients 500 Sheets 1 Carton Office Products

Please note To determine whether you need to use 1099MISC forms or the new 1099NEC forms introduced in , please click here for more information Recipient Copy B, to send to recipient Compatible with QuickBooks and most major accounting programs For laser or inkjet printers This is because a PDF or scanned copy will not be accepted Bear in mind that if you decide to mail a physical copy, you will also need to file Form 1096, which is designed to track each physical 1099 you have filed Send Copy B to your contractor on or by January 31st or the following nonholiday business day Copy B Contractor / Vendor;

1099 Nec Recipient Copy B Cut Sheet Hrdirect

3

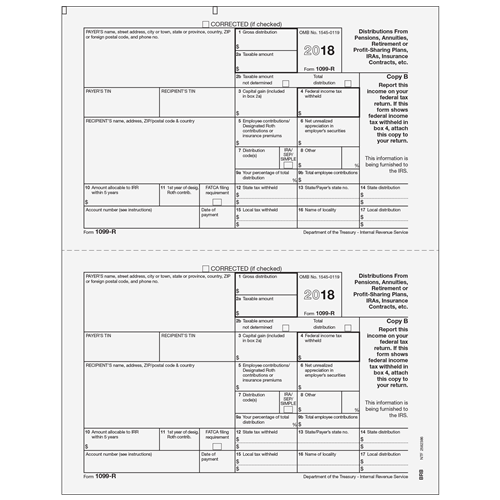

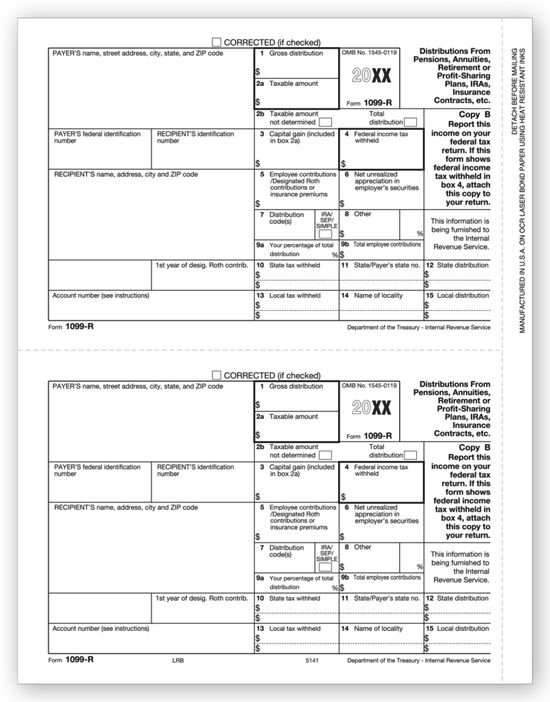

Form 1099R reports the gross distribution from the custodian and how much of that amount is taxable The plan owner uses this information to fill out lines 15 and 16 on Form 1040 Copy B of Form 1099R is attached to Form 1040 only if federal income tax is withheld in box 4 of Form 10991099 Misc Copy B Laser Minimum order 50 For use in reporting rents, royalties, prizes and rewards, fees, commissions to nonemployees and healthcare payments Note 1099MISC NO longer used for NonEmployee Compensation If you typically file any 1099MISC forms (with Box 7 completed), you will need to file Form 1099NEC for tax yearIn this article we'll consider a more indepth take a look at what a 1099 Form is, and the way it can help you and your little company

1099 Nec Form Copy B Recipient Zbp Forms

1099 Oid Tax Form Copy B Laser W 2taxforms Com

1099 Misc Laser Copy B Income Recipient Pack for 100 Recipients 19 Copy B Visit the Dutymark Store 33 out of 5 stars 2 ratings Currently unavailable We don't know when or if this item will be back in stock This fits your Make sure this I have a 1099R (copy B) and a 1099R (copyC)) are these different They are the same If you went to a tax preparer, they would keep one copyLaser 1099MISC Income, Recipient Copy B Use to Report Miscellaneous payments Compatible with laser or inkjet printers Government approved # bond paper Two forms per sheet of each copy For 24 Recipients

Form 1099 Misc 2up Miscellaneous Income Recipient Copies B 2 Bmisb5

1099 Misc Recipient Copy B Packs Of 50 Lmb Print Promo Plus Business Solutions Services Supplies

The 1099 report is not a multipart form, so a new report "1099 part B" can be used when printing the part B copy to be sent out to vendors Copy the standard L report, save it as a new user report (Mask) Add the new report format for this screen in Report Control Maintenance Create a new formula in Crystal I called it TINMaskKnow the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keepingCopy 2 Contractor / Vendor;

1099 Misc Miscellaneous 2 Up Horizontal Copy B 2 11 Z Fold 500 Forms Ctn

Copy Of 1099

Copy C Your records;Preprinted 1099INT for Reporting Interest Income This form is in a 2up format on 8 1/2 by 11" paper Recipient Copy B Use with 1099 Double Window Envelope for 2up Forms #DWMR OR Use with 1099 SelfSealing Double Window Envelope for 2up Forms #DWMRS Please note that this form is for the current tax year 1099 B Form Copy B – What exactly are 1099 Forms?

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Tax Form 1099 R Copy B Recipient 5141 Form Center

Official 1099A Tax Forms for Borrower Use the 1099A form Copy B to print and mail information about the acquisition or abandonment of a secured property to the borrower, for submission with their federal tax return Don't forget compatible 1099 envelopes!Vertical at 1/2" from Right Product Information File Form 1099MISC, Miscellaneous Income, for each person to whom you have paid during the year At least $10 in royalties Broker payments in lieu of dividends or taxexempt Size 8 1/2" x 11" Form 1099MISC Format 2 up Copies Copy B Ink Color Black Perforation Horizontal at 5 1/2";

Tf5157 Laser 1099 G Payer And Or Borrower Copy B 8 1 2 X 11

Tax Form 1099 Misc Copy B Recipient 5111 Form Center

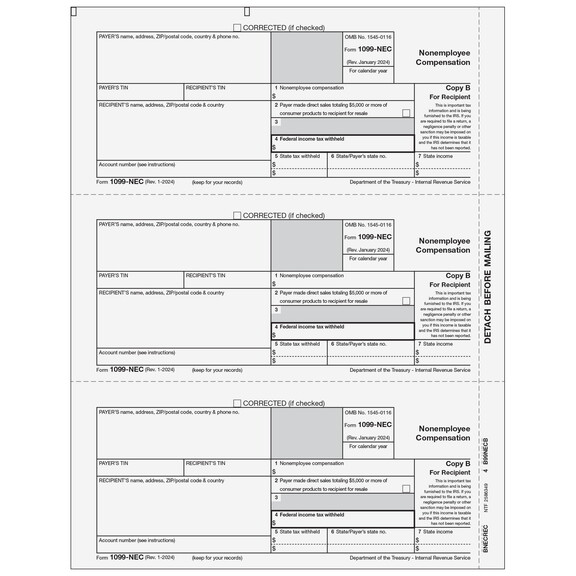

Back Of Copy B Of Form 1099 MISC – When a individual is searching to hire a new occupation, the simplest way to find out if they are hiring the right individual would be to consider the time to complete an IRS 1099 Form This form is utilized by many various companies and it will assist determine if the business is a scam or notTherefore, the signNow web application is a musthave for completing and signing form 1099 g copy b on the go In a matter of seconds, receive an electronic document with a legallybinding esignature Get 17 fillable 1099 g signed right from your smartphone using these six tips Type signnowcom in your phone's browser and log in to yourNonEmployee CompensationUse Form 1099NEC Copy B to print and mail payment information to the recipient for submission with their federal tax return 1099NEC forms are printed in a 3up formatForms are 8 1/2" x 11" with no side perforation and are printed on # laser paper Mail recipient copies in compatible window envelopes

1099 Form Fillable Fill Online Printable Fillable Blank Pdffiller

Irs Approved 1099 Div Laser Recipient Copy B Walmart Com Walmart Com

Form 1099NEC vs 1099MISC Form 1099NEC is reserved for individuals who provide you with services but who don't work for you as an employee It's also used for attorneys under some circumstances, and for anyone from whom you purchase fish or "other aquatic life," but only if you make the purchase with cash and the individual is someone whose business is The Balance / Evan Polenghi A 1099MISC tax form is used for reporting taxable payments from your business to a variety of payees You must report payments you make to miscellaneous types of payees during the year, and you must give these reports to the payee and send them to the IRSMake Manual Adjustments (Adjust Withholding ) Complete Withholding Vendor Update (Upda te Vendor Withholding s) OR Withholding Invoice Line Update

1099 Misc Miscellaneous 2 Up Recipient Copy B Creative Document Solutions Llc

1099 Misc 3up Combined Format Laser W 2taxforms Com

Miscellaneous InformationUse Form 1099MISC Copy B to print and mail payment information to the recipient for submission with their federal tax return 1099MISC forms are printed in a 2up format Forms are 8 1/2" x 11" with no side perforation and are printed on # laser paper Mail recipient copies in compatible window envelopesMake Manual Adjustments (Adjust Withholding)2 Do I have to send the top and bottom?

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy

New 1099NEC Tax Forms for – Copy B/2 for Recipient and State Copy B/2 forms to print one form that has both copies required for a single recipient Use 1099NEC Forms to report nonemployee compensation of $600 for contractors, freelancers and more If you used 1099MISC forms to report nonemployee compensation in Box 7, you MUST USE THIS NEW FORM for theOrder the quantity equal to the number of recipients you have – minimum 25 / multiples of 251099MISC Miscellaneous Recipient Copy B, Payer/State Copy C & State/Extra file copy laser cut forms This 1099MISC form allows you to report miscellaneous payments, and nonemployee compensation 85" x 11", Printed in Black ink, 1 sided (500 per Carton)

1099 Misc Laser Recipients Copy B

Form 1099 Misc Miscellaneous Income Recipient Copy B

When you file Forms 1099MISC or 1099NEC with the IRS, you must also send Form 1096, Annual Summary and Transmittal of US Information Return There is only one 1096 Form 1096 has a section where you must mark the type of form being filled

Standard Register 10 Laser Tax Forms 1099misc Copy B 50 Sheets Per Pack Sr Direct

Super Forms 1099 Nec 2up Recipient Copy B Bnecrec05 Sale Reviews Opentip

Form 1099 Int Interest Income Recipient Copy B

1099 Int Form Copy B Recipient Zbp Forms

How To Fill Out And Print 1099 Misc Forms

1099 B Form Copy B Recipient Zbp Forms

1099 B Form 4 Part Carbonless Discount Tax Forms

1099 Misc Forms 4 Part 18 Laser Tax Forms For 25 Vendors Pack Of Federal Copy A Recipient Copy B State Payer Copy C 1096 Transmittal Sheets Irs Compliant Buy

3

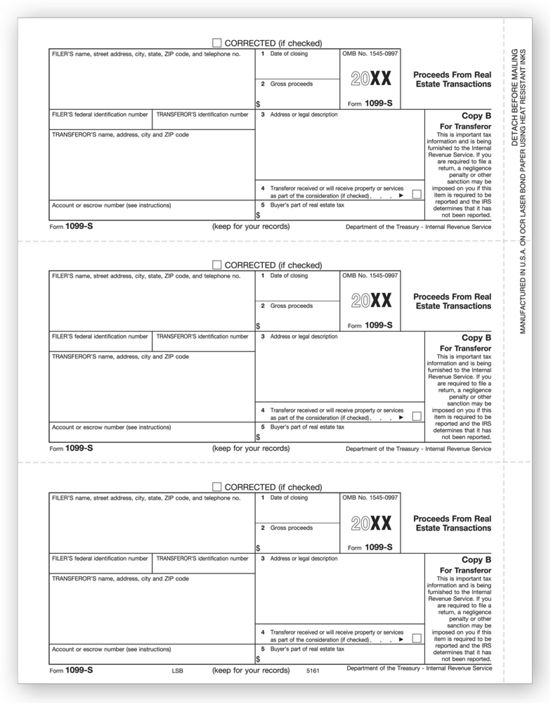

21 Laser 1099 S Copy B Bulk Deluxe Com

Irs Approved 1099 R Laser Copy B 100 Recipients Year 19 Walmart Com Walmart Com

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Pdf F1099msc Pdf

Tf5112b 2 Up 1099 Misc Laser Payer State Copy C Tax Forms In Bulk Packs

Tf5161 Laser 1099 S Recipient Copy B 8 1 2 X 11

1099 Misc Miscellaneous Income Recipient Copy B 2up

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

1099 Misc Recipient Copy B Laser Forms

1099 Misc Archives W9manager

Form 1099 G Certain Government Payments Recipient Copy B

1099 Nec Form Copy B 2 Zbp Forms

Small Business 1099 Misc Reporting Requirements Dalby Wendland Co P C

1099 Int Laser Recipient Copy B

1099 Misc Tax Form Pressure Seal W 2taxforms Com

1099 Misc Form Copy B Recipient Zbp Forms

21 Laser 1099 B Recipient Copy B Deluxe Com

Amazon Com Egp Irs Approved 1099 B Laser Tax Form Federal Copy A Quantity 100 Recipients Tax Record Books Office Products

1099 S Form Copy B Transferor Discount Tax Forms

Laser 1099 Misc Recipient Copy B

1099 Int Recipient Copy B

1099 G Tax Form Copy B Laser W 2taxforms Com

Tax Form 1099 Int Copy B 2 Recipient 5121 Form Center

1099 B Form Copy A Federal Discount Tax Forms

5111

21 Laser 1099 Misc Income Recipient Copy B Deluxe Com

Form 1099 Misc Miscellaneous Income Recipient Copy B

How Do You File 1099 Misc Wp1099

Amazon Com Egp Irs Approved 1099 Oid Copy B Tax Form 100 Recipients Tax Record Books Office Products

1099 Misc Recipient Copy B

Laser 1099 Misc Forms Bradford Business Checks

Boidrec05 Form 1099 Oid Original Issue Discount Copy B Recipient Nelcosolutions Com

1099 Misc Form 1 Part E Filing Carbonless Form Discount Tax Forms

Amazon Com Irs Approved 1099 Int Copy B Tax Form 100 Forms Office Products

1099 R Form Copy B Recipient Zbp Forms

1099 A Tax Form Copy B Laser W 2taxforms Com

1099misc Copy B Lmb Zbp Forms

Form 1099 Misc To Report Miscellaneous Income

Form 1099 Nec Instructions And Tax Reporting Guide

Tf5111b 2 Up Laser 1099 Misc Recipient Copy B Tax Forms In Bulk Packs

Tf5141 Laser 1099 R Copy B 8 1 2 X 11

Ps Acl Print Options Public Documents 1099 Pro Wiki

1099 Int Form Copy B Recipient Discount Tax Forms

1099 R 2up Distributions From Pensions Etc Copy B Recipient Federal Brb05

5111

21 Laser 1099 R Copy B Deluxe Com

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 B Tax Form Copy B Laser W 2taxforms Com

1099 Nec Software Software To Create Print And E File Form 1099 Nec

1099 K Form Copy B Payee Discount Tax Forms

1099 C Form Copy B Debtor Discount Tax Forms

Use Form 1099 Nec To Report Non Employee Compensation In

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

Form 1099 R Recipient Copy B

Printable 1099 Forms Copy B Fill Online Printable Fillable Blank Pdffiller

1

2 Up Blank 1099 Misc Tax Form With Employee Instructions Copy B 2 5159 Form Center

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

21 Laser 1099 Int Income Recipient Copy B Bulk Deluxe Com

1099 R Recipient Federal Copy B

Amazon Com 1099 Int Copy B Tax Form 100 Forms 50 Sheets Office Products

1099 Misc Laser Recipient Copy B For 21 627 Tf5111

Nec5111 2 Up Laser 1099 Nec Recipient Copy B Tax Form With Nec Non Employee Compensation New Form

0 件のコメント:

コメントを投稿